The IEA estimates more than 7 trillion USD needed to be spent towards the hydrogen segment to achieve net zero emissions of greenhouse gases by 2050. The organization also cites the disparity between the pledges being made by nations and the necessary steps being taken. Hundreds of millions of dollars will likely be spent on valves for hydrogen applications. There is an existing market in the steel and chemical industries and automotive companies are racing to be the first to use hydrogen fuel cells. The power industry is planning to burn hydrogen in gas turbines to replace at least some of the natural gas.

By Bob McIlvaine, President & Founder – The McIlvaine Company

Certain applications such as heavy-duty transport including rail, ship, or land, are more promising than others for the short-term transition to hydrogen. However, looking toward long-term goals, the attractiveness of hydrogen from a renewability standpoint is increasingly compelling. The challenges here lie within the wind, solar, hydropower, and geothermal sources; these resources and markets are likely to face gaps. Transmission can be costly and involve some negative environmental aspects.

Hydrogen can be transported as a compressed gas or as a liquid. It can be transported as ammonia without it needing to be stored or transported in extremely cold temperatures. Currently, less than 100 million tonnes of hydrogen is consumed, and it is estimated that 90% of the hydrogen which will be used in the next decade will be tied to environmental improvement.

These opportunities will have the chance to thrive with the advent of new applications; this presents challenges to valve suppliers. These challenges include determining the type of market that suppliers should accommodate and which products should be adapted to achieve significant market share.

Valve designs are needed for refineries and steel mills, and these design plans will be different from the equipment that is used for hydrogen fuel cells used in long-haul trucking. Even within an application, there could be process, instrument, transfer, or transport requirements that involve specialized valve designs.

Facts, Factors, and Forecasts

Based on the many different variables in markets and technologies, valve suppliers must analyze each niche with the appropriate facts, factors, and forecasts. For example, the power market can be significantly large, however, the most present activity takes place in transportation. It is better to view hydrogen as the aggregate of thousands of niches rather than a single market. South Korea, for example is taking the lead in transport. China has been viewed separately due to its size and political uncertainties. The country lacks natural gas and is the leading converter of solid fuels to gas. The hundreds of coal gasification plants could potentially be converted to produce hydrogen. Much of the potential renewable energy deployed in electrolyzers will come from places such as Iceland and its use of geothermal power. Arab states, on the other hand, utilize their deserts for solar energy capture. Some predict that electrolyzers will produce more electricity than any other fuel source by the turn of the century.

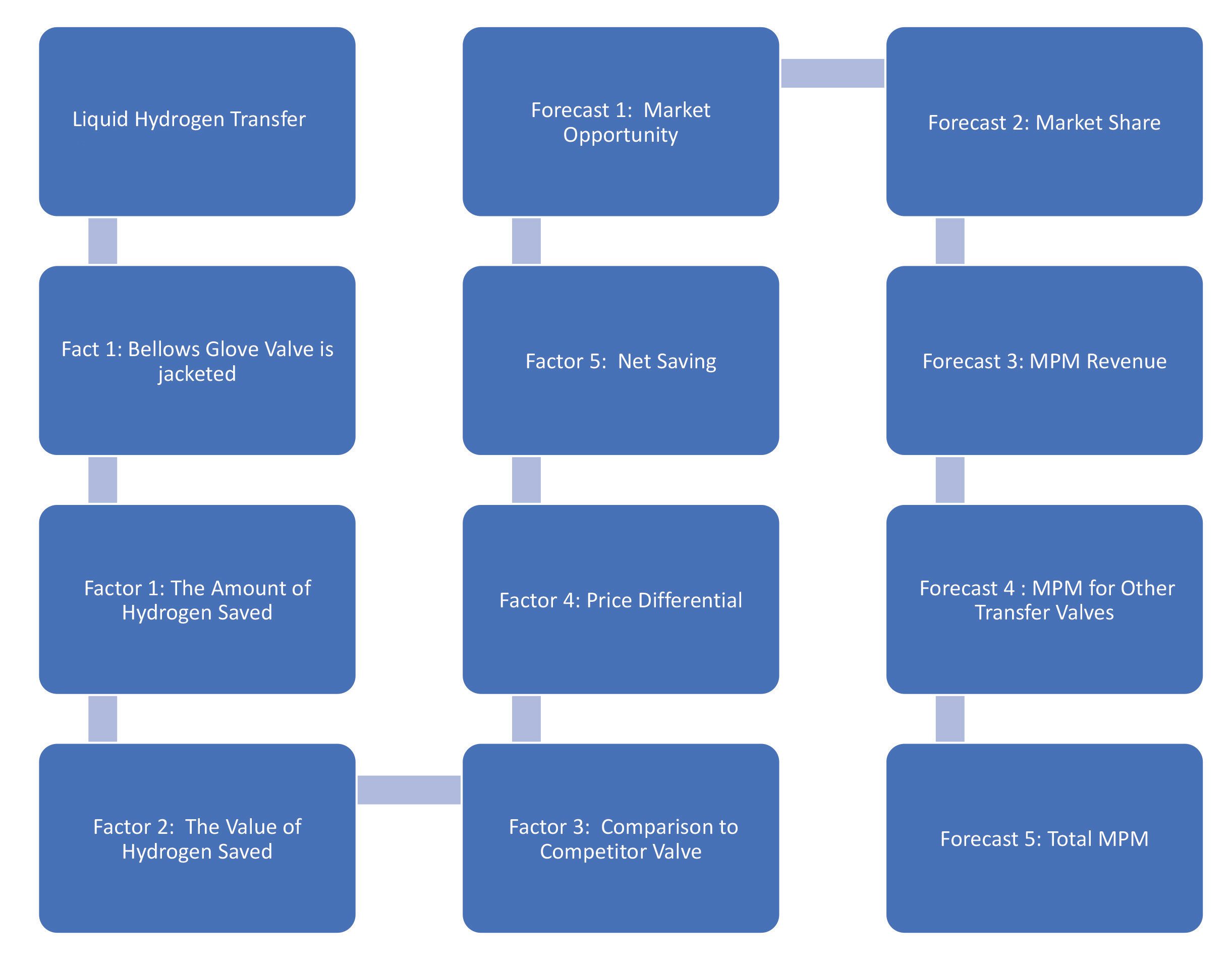

Each niche has unique facts and factors which shape market forecasts1, value proposition, market share, and lowest total cost of ownership. The Most Profitable Market (MPM) for a supplier is an aggregation of niches, where one can generate a high market share and EBITDA. This is possible when a product can be adapted to offer the lowest total cost of ownership (LTCO). For example, Crane ChemPharma & Energy offers a new globe valve design with some unique claimed advantages. The bellows Globe Valve is jacketed and otherwise designed to minimize heat transfer.

Considering Jacketed Bellows Globe Valves

Valve facts are converted and used as factors to consider that impact the cost of ownership. The differences in competitive products must be analyzed. The market share at various EBITA levels needs to be assessed and the criteria of a 20% market share should be consistently met as the minimum target. Finally, this opportunity can be viewed as part of several different aggregations. Transfer valves used for just hydrogen would be considered a narrow focus; another would be an aggregate for all cryogenic valve opportunities. Additionally, the option to combine the market opportunity for complementary products has proven to work well for some manufacturers and suppliers.

Many of the facts and factors that apply to one product, also apply to others. This makes it highly desirable to supply complementary products in a niche. An example of a valve company which is pursuing hydrogen with complementary products is Parker Hannifin. Parker has made over 80 acquisitions in the last five years. Clarcor, Meggit, and Bestobell all expanded the complementary product range for hydrogen. This builds on Parker’s hydrogen fuel cell experience dating back 50 years. Acquisitions have been important in creating this complementary portfolio. In 2017 Parker Hannifin purchased Clarcor, a company that makes liquid and gas filters. This provided opportunities from small liquid filters for pump lubrication up through the fuel cell membranes. Complete piping systems are also supplied. Hydrogen generators utilize a proton exchange membrane, which eliminates the use of liquid electrolytes.

Conclusion

There are tremendous uncertainties relative to the timing of various niche markets as well as the technology to be employed. This makes it especially important to analyze each niche and continually refocus to maximize profits. The valve industry will find challenges in determining the market and creating adaptive products that achieve a significant market share, however, companies offering complementary products for hydrogen will have an advantage.

Finding a narrow focus on various valves for hydrogen transfer enables an accumulative market opportunity amongst many niches. Industry professionals will notice the attractiveness of hydrogen in the form of renewable energy, especially to reach net-zero emissions by 2050. In the meantime, it is important to consider all factors that pertain to this change which will, in turn, be a critical component in producing and designing new components for this global push.