By Robert McIlvaine, President & Founder – The McIlvaine Company

Posted by Sarah Bradley

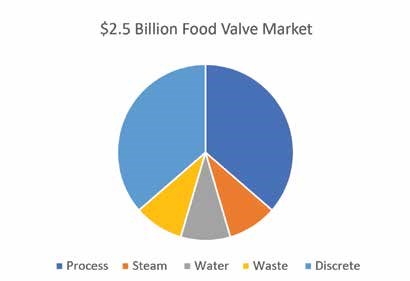

The valve market for processing equipment is valued at well over USD $2.5 billion per year. When discrete applications are included and a broader definition of valve products are used, the market is worth closer to USD $6 bilion. 1

The Food Market in Relation to Valves

The food and beverage market includes not only valves, which are used directly in the creation process, but also the materials required in the use of utilities such as water, electricity, and waste treatment. Many food processing companies even generate their own electricity and utilize small processors to generate steam. The treatment of wastewater on site, for example, rather than discharging it to a public treatment plant, is common. In fact, in several small towns the food processing company also supplies municipal wastewater treatment for the residents.

Some of the world’s largest valve suppliers look at the food market and ask themselves: ‘Where can we sell the same valves we supply to other industries?’ This is a relevant question because it can lead to the most profitable orders. Much of the success that arises from this approach is from buying small companies who have found highly profitable niches.

The rationale is that if the market for an existing grade is expanded, the cost of production will be less, and the margins and earnings before interest, taxes, and amortization (EBITA) can be increased. However, some companies have taken a different approach; they ask: ‘What are the customer needs? Can we supply a product with lower total cost of ownership than our competitors?’

Some of the companies who have taken this ‘customer first’ approach have generated greater EBITA than the industry as a whole. Their approach is to thoroughly understand all the processes and the cost of ownership and then develop solutions which deliver lower costs than the competition.

This approach starts with a segmentation of the food and beverage markets and processes. The questions in each sector are as follows:

• How big is the market?

• How fast is the market growing?

• How important are valves in this market?

• What are the specific valves uses in general, critical, severe, and unique service?

To understand this process more thoroughly, different market avenues are explored.

Different Market Avenues Beverages

Beer is the largest beverage market, and valves represent a relatively large percentage of this sector, compared to other industry revenues. There are both critical and severe service applications in beer operations. Wine, spirits, and other beverages are also substantial markets for critical and severe service applications. This means that there is substantial opportunity to provide innovative designs with lower total cost of ownership. One criterion is preservation of product quality.

Another area valves play a key role in, is the milk separation and pasteurization processes.

Food

The poultry, meat, and seafood industry are the largest in the food market. While it is a big market for valves, in relationship to total industry sales, valves are quite small.

The sugar industry is also a big market for valves, though sugar applications differ between cane and beet sugar. Cane sugar involves disposal of the waste (bagasse) which has substantial fuel value, while cane sugar milling and refining can be undertaken in different locations (see Figure 3).

After determining how a specific valve can provide the lowest total cost of ownership in a cane milling application, the best prospects can be identified. Thailand is a major purchaser of valves for sugar, even though it is a small purchaser in other food segments. Thailand has eight major sugar producers and 49 sugar factories; each has site-specific factors to incorporate. Its electricity prices are in the middle at USD $0.11/kwh. So lower valve power requirements can be quantified. In some applications the valves used for dry conveying of product represent a larger market than the valves used for moving liquids.

Valve Specifications

Some of the most critical applications that use valves involve moving product as a liquid slurry. For example, diaphragm valves provide the accuracy and sanitary aspects need for food products and are therefore widely used. Various suppliers have unique designs to meet the necessary specifications. The challenge is to translate these features into cost of ownership assessments.

GEA says its Vesta sterile valves meet the operational requirements for food processes, comply with the strictest safety regulations, and provide a high-quality product. The most important features of the innovative design are as follows: the hermetic and safe sealing by PTFE bellows with a patented sealing system, actuator systems made of high-grade synthetic material or stainless steel, and easy servicing. The Vesta sterile valve is for low volume flow rates, suitable for applications found in laboratories, and highly complex process plants. The valves prevent product contamination from the outside, ensure that the process system stays free of germs, and offer the following design benefits: • Pocket-free design without domes or pools;

-

- Valve body drains completely in straight pipes;

- PTFE bellows as shut-off element for universal applications;

- Long service life of the PTFE bellows;

- Patented bellows sealing system hermetically, safely and permanently seals off the valve interior against the outer atmosphere;

- Compact design due to newly developed actuator systems;

- Reliable CIP/SIP cleaning thanks to optimized flow characteristics;

- Hygienic outer design, that meets EHEDG/cGMP standards;

- Simple and safe maintenance.Another example of unique designs is the Watson Marlow Asepco. It states that its diaphragm valves can be most cost effective because:• No tools or special training required;

- Integrated, non-adjustable travel stops;

- No dead legs or dead spaces;

- Flush mount design and simple clamp assembly.The conclusion is that the valve will save time and money compared to conventional basic weir-style diaphragm valves.ITT says that its EnviZion diaphragm valve has embedded technologies for a more streamlined installation and maintenance process, delivering less downtime, longer preventative maintenance cycles, and greater production capacity for manufacturers. Assembled with a simple mount and turn motion, the EnviZion valve is installed in approximately three minutes without using any special tools or difficult torquing procedures. The valve’s 360° active seal protection provides leak-free operation, helping eliminate the risk of contamination and the need to retorque after thermal cycling.In the past, the purchaser has been challenged to weigh the various claims and features for their specific requirements. The implementation of the Industrial Internet of Wisdom (IIOW) gives the purchaser access to the actionable information which is available in each of these process niches.

Final Thoughts

The analysis of each valve application, and each process that requires them, can become the foundation of the business strategy, rather than a peripheral tool. The identification of the purchasers can therefore be an asset to expanding each valve market.

References

(1) Valves: World Markets published by the McIlvaine Company

About the Author

Robert McIlvaine is the CEO of the McIlvaine Company which publishes Industrial Valves: World Markets. He was a pollution control company executive prior to 1974 when he founded the present company. He oversees a staff of 30 people in the U.S. and China.

http://www.mcilvainecompany.com