Managers of valve companies urgently need a more flexible strategy based on a range of market forecasts. The impact of COVID-19 and the Chinese tariff war pale in comparison to the crisis in Eastern Europe.

By Robert McIlvaine, President & Founder – The McIlvaine Company

Historical Perspective

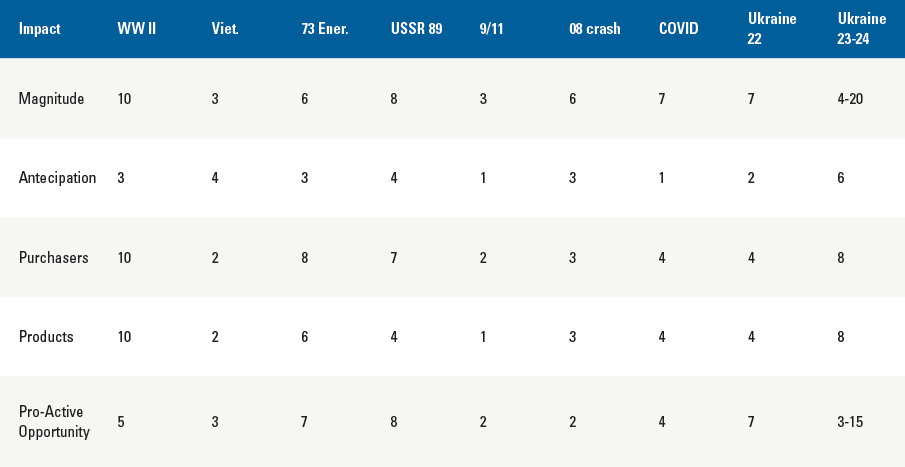

To understand the potential impact of the current crisis in Eastern Europe, it is helpful to compare the impacts of past crises on valve companies.

Figure 1 highlights the varying impacts significant world events had on the industrial valve market. World War II is used as a base for relative magnitude of 10. No event, until now, has compared in terms of the impact on purchasing. Not only was the magnitude not anticipated by most, the conflict completely changed the type of purchasers. The products became valves for tanks and planes rather than automobiles. Valve suppliers were primarily reactive.

The 1973 energy crisis was small in magnitude, compared to WW II, but created many proactive opportunities for valve suppliers in coal gasification and liquefaction as well as shale. U.S. utilities ordered 80,000 MW of new coal plants which turned out to be more capacity than has been actually installed in the 1974-2022 period. Within two years, however, the Organization of the Petroleum Exporting Countries (OPEC) resumed normal production and the crisis ceased. Rather than continue with energy independence, the U.S. canceled all the partially completed and planned projects.

This is not likely to be the case in the present crisis. The current conflict between Russia and the Ukraine has galvanized the free world to escape the OPEC/Russia yoke. One possible outcome of this departure from OPEC is a Transworld Partnership. The impact on valves could therefore be higher than it was in World War II.

Flexible Strategy

Due to the many uncertainties associated with the current conflict, McIlvaine’s forecasts for valves will now include high, base and low predictions.1

One possible scenario could be labeled Tactical Nukes and Restricted Trade. The world’s industrial valve purchases could quickly drop from $80 billion to $40 billion. On the other hand the Grey-Blue Two Step and Transworld Partnership could result in a decade of valve EBITA growth at a CAGR of more than 5%.

Under the Tactical Nuke, Restricted Trade scenario valve suppliers cannot be proactive. But with the Grey-Blue Two Step and Transworld Partnership there will be many proactive opportunities.

One of the most important objectives could be to reduce reliance on Russian and Saudi energy. In the short term the U.S has become the leading supplier of gas to Europe. The IEA forecasts that an immediate reduction of European gas needs of 30% can be achieved by utilizing the nuclear and coal capacity and with some consumer restraint.

Long term, solar and wind power use can obsolesce fossil fuels. For the next 30 years, however, the use of fossil fuel resources will be necessary. Over 20 million tons of hydrogen per year are being produced from coal in China, while Indonesia has a big coal to methanol project underway. Pakistan has more energy reserves with Thar lignite than all the oil & gas reserves in Saudi Arabia. This lignite can be used to create methane, hydrogen, or ammonia. Carbon capture and sequestration can be added later. Bioenergy with carbon capture is carbon negative. So there is no tipping point. If more carbon negative technology is applied in the 2030-2050 period it could offset any increase in the next 10 years.

All these technologies involving fossil fuels require major investments in valves. New systems, such as in situ capture of rare earths during combustion, will prove to be very cost effective. Forecasts will be critical for valve companies not only to prepare for what will be needed but to actually shape the needs.

Forecasts

McIlvaine will be adjusting market forecasts as the situation develops. Figure 2 highlights some potential effects on valve suppliers if a new energy source/system is put into place.

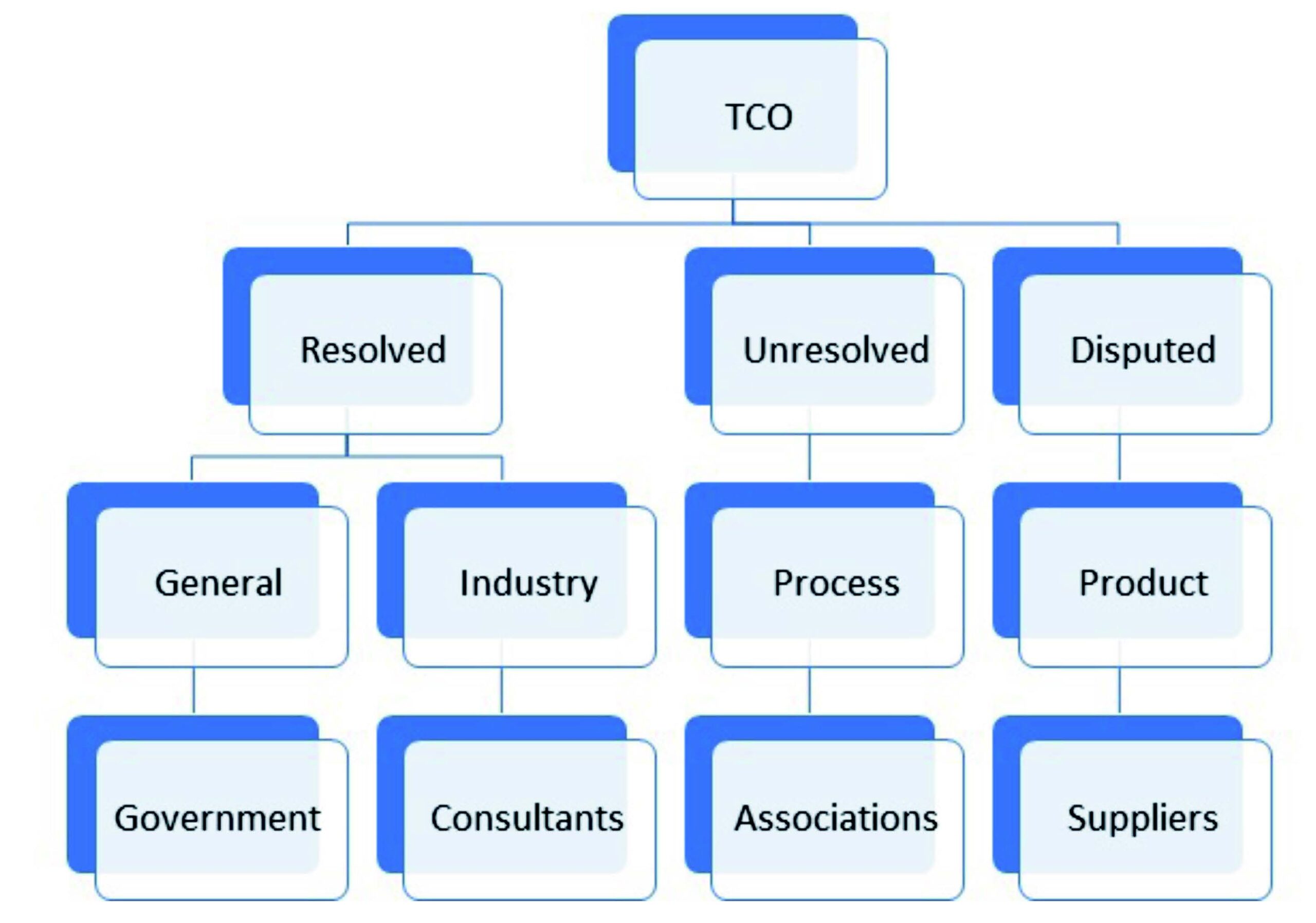

Based on the varying forecasts, it is in the best interest of valve companies to quantify their potential markets and understand the product needs. These needs can be characterized by their cost of ownership factors. The Total Cost of Ownership (TCO) will be determined by connecting all the sources of wisdom. The TCO concept extends beyond business to political decisions. If for example, one country sides with another, each of the possible counter measures will have a cost which has to be considered before a choice is made.

The best decisions will be made if there are strong Industrial Internet of Wisdom (IIoW) decision loops which connect all parties on a continuous basis. The complexity and urgency make the disconnected present approach unwise.

Looking Forward

With all the uncertainties caused by the current conflict, there are a number of unresolved issues. The wisdom of government bodies and consultants will be needed to determine the TCO factors. Consultants, industry associations, and suppliers will provide industry insights such as green versus grey hydrogen, while system suppliers compare processes such as hydrogen versus ammonia for combustion. Product suppliers will also provide cost factors for the increased NOx control products required while burning hydrogen.

The product factors will be disputed by individual valve suppliers and will need to be carefully evaluated. History shows that when one approach is selected initially it is hard to substitute a better alternative.

In order for valve forecasts to be useful, multiple predictions will need to be based on the decision loop wisdom. The valve companies should have a flexible strategy which will maximize earnings before interest, taxes, and amortization (EBITA) under each scenario.

REFERENCE

1. Industrial Valves: World Markets published by the McIlvaine Company.

ABOUT THE AUTHOR

Bob McIlvaine founded the McIlvaine Company in 1974 and oversees the work of 30 analysts and researchers. He has a BA degree from Princeton University.