Starting in the company’s sales department in 2006, Mr. Zhu is now responsible for VIZA’s marketing and sales. He is thankful to have had the opportunity to grow up together with the company. VIZA has cultivated the business philosophy of “never forget why you started, and your mission can be accomplished”. Its employees are far-sighted enough to see that the healthy ecosystem of the valve industry and its steady development is the cornerstone of their own progress.

By Yolanda Xue

Established in 1998, VIZA has maintained steady growth for over 20 years and has evolved into a leading valve enterprise in the global market, owing to its decades of valve expertise. VIZA’s products have been widely applied in various industry sectors including oil & gas, long-distance pipelines, petroleum refining, chemical & petrochemical production, firepower, defense, geothermal and photovoltaic power generation, LNG, shipbuilding, mining and water treatment. The company is recognized as a high-quality supplier by a number of international energy companies.

Building on its business as an export-oriented manufacturer, VIZA focuses on the global market including North America, Europe, the Middle East, Latin America, Southeast Asia, Australia and beyond. Aside from traditional markets, VIZA is now keeping a close eye on some rising markets, for instance BRIC countries (Brazil, Russia, India, and China), North Africa and Iraq.

American Market Remains its Top Priority

Entering the American market in 2008, VIZA was one of the earliest Chinese valve manufacturers with the vision to seize opportunities from such an energetic market. Mr. Zhu said that the American market is one of the most important for VIZA as its total market share of the United States, Canada and Latin American countries normally accounts for 40% of the overall number.

“Its importance first comes from the order volume brought in by the market itself. Sometimes it accounts for about 60% to 70% of our total order volume as the U.S. is already the largest market plus Canada, Mexico and the southern part of Latin America, so the overall volume is huge,” Mr. Zhu explained. “In addition, VIZA invests about 40% to 50% of the total on this market, so you can see that our valves are mainly of American standard. Generally speaking, the U.S. market holds top position in our business layout.”

He said that the game rules of the U.S. market are not the same as those who are project-driven. The U.S. market is dominated by distributors who sign long-term contracts directly with end users. “The threshold to access the American market, especially the U.S., is high — it is not easy. Through attending local exhibitions, making contact with local valve enterprises and being led to a larger supply chain, we have gained experience in talking with American end users. After that, some local distributors naturally come to us.”

However, this is not always the case. Mr. Zhu said these days many American end users, including those who are multinational enterprises with factories on every continent of the world, are gradually changing to prefer ‘direct purchase’ and contact manufacturers directly through the global supply chain. “Economic downturn caused financial pressure to distributors in the U.S., some of them sold core businesses or have been merged and restructured with other enterprises. Large-scaled distributors are moving towards more digitalized platforms, maintaining zero inventory or keeping most of the inventory in manufacturers has been normal. The U.S. market becomes more unpredictable and diversified, the good thing is it brings opportunities to new players.”

Mr. Zhu believes that the American valve market flourished before the epidemic outbreak due to the recovery of oil prices, now it is at a low ebb mainly due to political factors and customers tend to be cautious in placing orders. “We think there is still great potential in this market as the economy begins to recover with a growing market demand. VIZA’s strategy is to insist on maintaining a more solid customer relationship and introducing newer and better products through existing channels. The ability to seize opportunities is particularly important and a long-term gameplay is needed in this process,” he said.

Shale Gas and Marine Engineering Applications

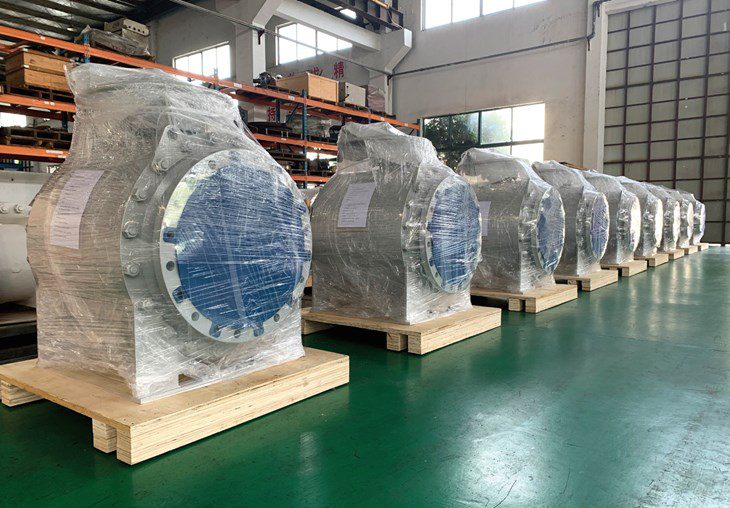

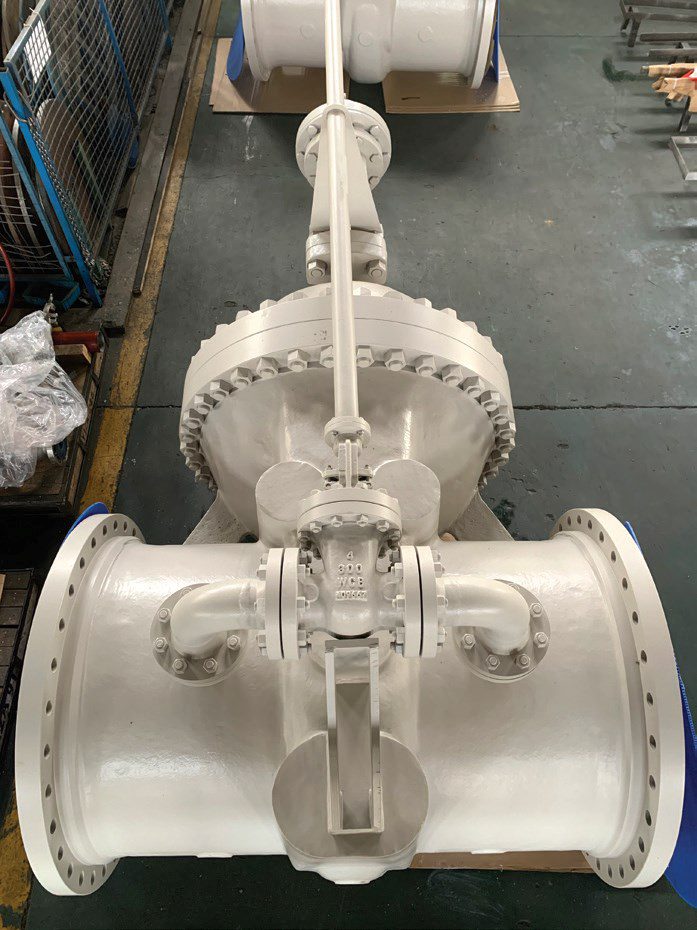

VIZA’s products are mainly applied in the upstream field of shale gas and other petrochemical industries, as well as in part of the downstream refinery chemical industry especially in the U.S. market where shale gas is booming. During the rapid growth period of the shale gas industry in the U.S., VIZA provided many large-diameter, high-pressure, hard-sealed ball valves in the oil and gas fields, wellheads, etc., including top-mounted ball valves applied to special working conditions.

“Shale oil and shale gas are closely connected. The U.S. was a huge importing country for oil and now it has become an oil exporter. I believe there is still a lot of room for growth in this field. However, the existence of some problems cannot be ignored, for example the cost of shale gas is relatively high. It is possible that in the future the U.S. will liquefy shale gas and export it through LNG ships as LNG technology develops,” Mr. Zhu further explained. “LNG has attracted worldwide attention and ultra-low temperature applications is a key element involved. China has built many LNG receiving terminals along the coast and many applications are going on across the American continent as well. That is where VIZA is heading and why we invested a lot in cryogenic valves.”

Moreover, the marine valve is another potential product that VIZA is turning its attention to. He said, “China is progressing from low-end to high-end bulk carriers due to the increasing popularity of FPSO. I believe China has a lot of demand in this respect as well as the U.S. — both of them will go with the trend.”

Ball valves are the most popular category among all VIZA products on the U.S. market, including hard-sealed, top-mounted ball valves, emergency shutdown valves together with gate valves, globe valves, check valves and butterfly valves applied on engineering projects. In addition, VIZA also sees a substantial increase of demand in wellhead high pressure ball valves for oilfield services.

From his observation, Mr. Zhu said the biggest change from the end user side is that clients ask more for high-end valves in aspects of material, design, performance and service with more stringent budget control. “That means end users wish to spend less money for better and faster products and service, raising a great challenge for suppliers,” said Mr. Zhu.

Exploration on Clean Energy

Observing a rising trend of “oil-to-energy” transformation, in Mr. Zhu’s view, valve enterprises should go with the flow and embrace the change. Actively participating in projects related to energy storage power stations, geothermal, LNG and others, VIZA has become deeply involved in clean energy through attending industry forums, understanding market trends and gradually building a theoretical basis for entering new fields such as hydrogen.

“Small in molecular weight and extremely active, hydrogen runs a higher risk explosion. If under high pressure or high temperature, the requirements for the compactness of materials are stricter than that of the traditional petrochemical sector. Therefore, the key is how to solve safety problems when applying valves on hydrogen,” he said.

When it comes to the topics of carbon neutralization and carbon emissions that have prompted heated discussion around the globe, he said: “It is a problem that the entire industry chain should work together on, but if we consider how valve suppliers can contribute to it, energy-saving and environmentally-friendly products should be the most important part. Finer, more intelligent, higher performance valves help to avoid leakage and lead to less emissions.”

Changes and Challenges

VIZA’s Houston office operates its core business throughout the American continent with the focus on the U.S. market. In Latin America, Europe and Southeast Asia, VIZA supports local agents and distributors and treats them as customers.

As an important market in Latin America and one of the BRIC countries, Brazil is another successful case of market development in VIZA’s growth path outside of China. Starting from OEM production in Brazil, VIZA obtained approval from end users, built its own brand image and finally became a reliable partner by supporting local distributors and cooperating with mainstream engineering companies. “A devotion to maintaining brand image and customer relationships bring business opportunities to us in multiple channels,” Mr. Zhu said proudly.

“Distance is not always negative in business. We believe that once we set foot in certain markets, we should always remember to contribute to local development. To maximize the result, local enterprises and talent are the best choice. VIZA is and will continue to focus on valve production while opening more channels and space to local partners,” he stated.

Mr. Zhu believes that the process American valve manufacturers are going through may be the future of Chinese enterprises. “Suppliers in the U.S. tend to be more brand-oriented: maintaining brand image, investing more in design, technology and customer service while making their own products outside the country because the global supply chain is rich enough to support them. Their challenges are: one, they rely so much on the relationship with end users and two, the management of their supply chain should be further strengthened.”

Mr. Zhu predicted that in the future, the global valve market will witness more profound competition in more sophisticated niche fields. “New brands may rise, and those long-established enterprises should constantly adapt themselves to changing needs, otherwise they might be eliminated from the market,” he concluded.

**The views and opinions expressed in this article are those of the profiled company and do not reflect the position of Valve World Americas.