This article describes four trends that are expected to dramatically impact power plant operations and control valve performance. It also provides examples of producers in the United States addressing these challenges and making the most of their scarce and stressed resources.

A Mature and Diverse Market

Power plants are defined by the primary energy source they use (such as coal or gas) and by the output they produce, measured in megawatts (MW). Because electricity cannot be stored and is expensive to export over long distances, power generation is primarily a local and regional business.

In the US alone, there are more than 225 power producers. One electric utility has 12 different subsidiaries operating hydro-electric, gas, coal, and nuclear facilities in ten countries on four continents. The parent company serves nine million customers across nine states. Like all the others, its portfolio includes new and old facilities feeding power to an aging transmission network.

This type of diversity reduces risk, but adds complexity. Each producer is challenged to simultaneously maintain its infrastructure, seize opportunities for growth, and still meet customer needs. Baseload plants using coal or gas to re the boilers generate a majority of the electric power used in the US — 33% each in 2014. The average age of a US coal plant is 42 years. In metro areas or during peak demand periods, some operate at maximum load, with legacy control systems and control valves struggling to manage rapidly changing operating profiles.

Over the next ten years, the production mix will change dramatically. Fossil fuel plants face more rules and more competition as a result of the nation’s proposed Clean Power Plan (CPP). According to an August 2016 report from the US Energy Information Administration (EIA), energy generation from renewable and nuclear sources will grow from 38% to 2015 to 45% by 2025.1

Turbines, Boilers, and Valves

On a global basis, 80% of all electricity is generated by steam turbines.2 They work best with slow acceleration and high-quality steam provided by boilers or heat recovery steam generators (HRSGs). How well you manage processes within the boilers and turbines—such as acceleration, vibration, steam temperature control, and even moisture content—determines the thermodynamic efficiency of the operation and the life of the facility.

Valves—modulating or throttling and on/ off—are essential to precise flow, temperature, and pressure control. Common to all fossil-fuel and nuclear power plants, valves are not only critical to the process, but they also help protect the turbines and boilers from harmful issues such as vibration or corrosion.

- Boiler startup valves control main steam pressure during startup and ensure adequate flow to the boiler. The good ones are engineered to handle extreme cavitation and pressure drops (up to 8,500 psi).

- Boiler feedpump recirculation valves operate in both on/off and modulating service.They often include custom trim to reduce noise or cavitation.

- Steam-conditioning valves often come with downstream desuperheaters to provide pressure and temperature control in one unit.

- Turbine bypass valves, usually found in combined-cycle plants, utilize boiler feed water and pressure reducing trim to condition the steam bypassed around the turbine for safe introduction to the condenser.

Like turbines and boilers, valves must be properly applied, operated, and maintained for the facility to run at optimum levels. For various reasons, four industry trends will influence a power producer’s ability to maintain equipment and maximize efficiency.

Trend #1: Growth of Renewables

The expanding use of wind turbines, solar panels, and even waste-burning units is making it harder for traditional coal, gas, and nuclear plants to compete. The Environment Protection Agency (EPA) is developing a Clean Power Plan (CPP) that is expected to accelerate the growth of renewable generation—by an average annual rate of 3.9%—and energy-efficiency projects across the country.3

In North America, electricity from renewable generators gets priority on the grid. When the wind blows at 12 mph, the average wind turbine produces two MW of electricity. When the wind doesn’t blow, however, traditional units— fossil-fuel, baseload designs— must make up the difference.

Producing power “on demand” means repeated stops and starts. This process, called thermal cycling, is hard on equipment.Traditional, baseload plants were not designed for that kind of punishment. Thermal cycling can literally stretch metal over time and lead to a host of performance and maintenance problems including weld fatigue, high noise, and vibration.

Trend #2: Increase in Thermal Cycling

About 60% of all coal-fired plant failures are related to cycling operations.4 Not only are temperatures and pressures changing more frequently, they are getting higher and hotter (up to 1200 degrees Fahrenheit and 4500 psi).

Power plants weld valves in-line and that makes valve maintenance more difficult. Over time, thermal cycling makes valve maintenance more frequent. The failure of a single valve can cause a safety issue or major operational problem and can mean personnel overtime. The time and cost to remove, disassemble, and repair the valve can blow a plant’s monthly maintenance budget. If the valve is large, its repair may require a crew and a crane.

If the valve was in a critical boiler or turbine application, its failure may cause a shutdown. An unplanned or forced outage because of a boiler tube leak at a power plant lasts an average of four days and costs an average of $2.6M USD. The cost adds up if the producer has to “buy” power from other sources to keep the lights on for their customers.

To maximize valve reliability and service life, be careful with selection and sizing, particularly for critical applications. Valve assemblies for severe operating conditions often feature custom materials and trim to tighten control, resist vibration, or handle extreme pressure drops. Asset management solutions, such as smart valve positioners, enable plant operators to monitor valve performance and predict—rather than react to—potentially costly equipment failures (figure 1).

As the demands on power plants change, so do the demands on control valves and piping systems. Look for a supplier with a reputation for innovation, production quality, factory support, and custom testing capabilities. You may pay more for these resources, but they all add value and improve the reliability and service life of your valve, once it’s welded in-line.

Trend #3: Increase in Regulations

With the new extremes in temperatures and pressures (up to 1200 degrees Fahrenheit and 4500 psi), safety remains a serious issue. In the early 1900s, the power industry struggled to establish codes, standards, and licensing requirements. Now, some producers would say there are too many.

Utility companies, particularly aging coal plants, feel like they’re under siege. When they’re not grappling with the costs and complexities of maintaining equipment, they’re reviewing pages of new rules to enhance safety or reduce pollutants. Consumers complain about the high cost of energy. Federal and state governments, not to mention environmentalists, demand that they reduce carbon emissions. How do power plants meet consumer needs, maximize their operational and economic efficiency, and still operate cleanly and safely?

Power plants are even being challenged to plan for and minimize the impact of unpredictable events such as earthquakes or terrorist attacks. The reactor failure at the Fukushima nuclear plant in Japan in 2011, for example, led to more audits and regulations for nuclear units around the globe.

In the US, the Nuclear Energy Institute (NEI) imposed “beyond design” requirements, meaning nuclear plants must have a plan for diverse and flexible protections in case of an extreme emergency. Nuclear valves and safety systems are helping many of the nation’s 100 commercial reactors meet NEI-FLEX requirements.

Carbon emissions are another hot topic and challenge for the power industry. CO2 levels influence air-quality and, according to many experts, contribute to global warming. These concerns are inspiring the shift from coal to gas and renewables.

As part of its Climate Action Plan, the EPA has revised carbon pollution standards for the power sector. Failure to comply to these new emission mandates may result in fines of up to $10,000 USD per violation per day.

Some older plants, already struggling with profit margins, will retire rather than invest in pollution control upgrades. Industry analysts say the electricity system as a whole won’t be compromised “if the industry and its regulators proactively manage the transition to a cleaner, more efficient generation fleet.”5 According to the EIA’s latest Short-Term Energy Outlook, natural-gas fired generation will exceed coal-fired generation by 2024.

Meanwhile, producers will rely on valve experts to provide better designs and control solutions to help them meet regulations.

Trend #4: Fewer In-House Resources

As Baby Boomers retire, a workforce transition is underway and the power industry will feel its effects. In the US alone, half of the electric utility workforce is expected to retire in the next ten years.6 And, they are taking their experience and specialized skills with them.

At the same time, the volume of technology and the rapid pace of its implementation magnifies the challenge of training new people. Inexperienced workers will enter the industry as processes, technologies, and valve applications get more complex.

This workforce shift also occurs in a time of economic instability, when many power plants face budget cuts. Accounts set aside for new capital projects, such as those to reduce emissions or increase capacity, are being diverted for transmission-system repairs or improvements. Will power plants have the time or money to invest in employee training? What options are available to train new people—and keep them up-to-date—without disrupting plant operations? Power producers are addressing these questions and the needs of their multi- generation workforce in several ways.

Implementing more automation and control technologies allows power plants to “do more with less” and augment the loss of experienced personnel. Adding smart positioners with digital communication and diagnostic capabilities, for example, enables one operator to monitor the performance of hundreds of valves. From the control room, an operator can access and analyze data supplied by smart instruments to determine what valves are struggling and, in many cases, why.

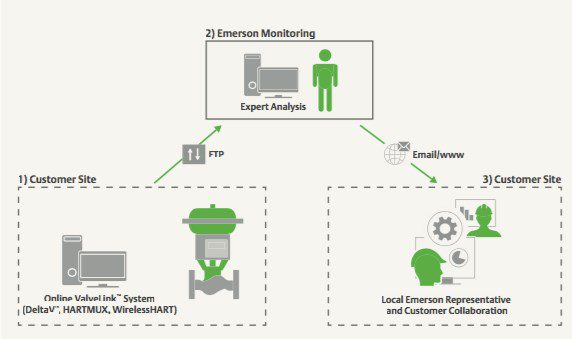

Nationwide, many generating units with valve monitoring and diagnostic capabilities have cut the annual cost of valve maintenance and/or extended the time between planned outages (figure 2).

Emerson

Other power producers are taking advantage of non-traditional training options to build competence and confidence in their new recruits. Online courses or how-to videos help get new workers up to speed, faster.

Traditional classroom courses are being offered locally and facilitated by certified, subject-matter experts. Suppliers are also hosting local seminars on specific topics–such as how to collect, interpret, and use the performance data about plant assets.

These innovative training resources help students gain a better, real-world understanding about power plant operation, engineering, and maintenance tasks. Power plant managers are seeking more outside support from solution and service experts. With big, complex valves operating under high pressure, they need advice from application engineers who have experience selecting, sizing, and specifying control valves.

Experienced, local valve service technicians are also available to work with your plant’s maintenance team. The valve-related, on-site services they provide include help with safety audits, installation, calibration, diagnostics, and repairs.

Planning outages and anticipating maintenance needs is far less expensive than reacting to unplanned failures or shutdowns. Thus, power producers are working with valve suppliers to implement proactive maintenance programs.These programs range from using an on-site Asset Manager to review or update the maintenance database to negotiating a long-term valve maintenance contract with your best supplier.

Conclusion

Serious issues caused by control valve failures are costly, but many are also avoidable. With the right resources and preventative measures, power producers can improve process control and avoid leaks, expensive repairs, process upsets, and downtime. With support from their control valve supplier, power producers are finding ways to improve reliability, safety, and efficiency.

All of the key players in the North America power market are working to improve the safety and efficiency of their older plants. At the same time, they are investing in smart-grid technologies, biomass-fueled facilities, wind farms, or solar energy centers.

Automating and monitoring control valves leaves shrinking in-house maintenance teams with more time to focus on other critical business issues. Local suppliers with a connection to the OEM (original equipment manufacturer) provide the best, focused and timely support for valve applications and repairs.

The transition to cleaner energy options has begun, and it’s irreversible. With it, comes a host of operating challenges and regulations for the power industry. But, this transition is a good thing for all of us. Our power-generating system may be more complex and more difficult to manage, but its diversity is also essential to meeting consumer needs for the long term. When the wind doesn’t blow and the sun doesn’t shine, traditional generating facilities, fueled by coal, gas, or nuclear reactors, will keep the lights on.

The conversion from traditional-energy to renewable-energy generation will take decades. Until then, older, baseload plants must remain viable and safe. Control valve suppliers will assume a larger role in helping those plants continue, comply, and compete.

Sources

1. EIA, Today in Energy newsletter (August 2, 2016); article titled “Renewables Share of NA Electricity Mix Expected to Rise”

2. Electropedia, http://www.mpoweruk.com/steam_ turbines.htm

3. EIA, Today in Energy newsletter (June 17, 2016;) Article about Clean Power Plan

4. POWER magazine 2011, “Make Your Plant Ready for Cycling Operations.”

5. “Power Struggle” by David Roberts, August 2010 – http://grist.org

6. US Bureau of Labor and Statistics, 2010

7. POWER magazine, 2005 – EUCG Benchmarking survey on boiler tube failures