Any evaluation of valves for water and wastewater therefore needs to address the industrial and agricultural uses as well as those for drinking and sanitation.

By Robert McIlvaine, President & Founder – The McIlvaine Company

The U.S. is expected to spend USD $100 billion per year on municipal water and wastewater capital equipment and repairs over the next 10 years. This will be largely funded by states and localities as federal funding has dropped below USD $4 billion per year.

The Biden infrastructure bill will allocate USD $55 billion for water infrastructure. This funding includes USD $15 billion for lead pipe replacement, USD $10 billion for chemical clean-up, and money to provide clean drinking water in tribal communities.

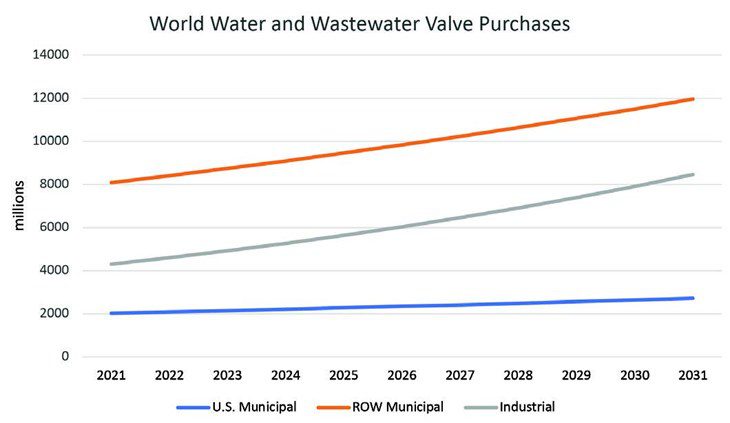

The net impact of this spending will only be a few billion dollars of additional water and wastewater infrastructure funding per year. The U.S. expenditures for water and wastewater valves for 2021 is projected to be USD $2.75 billion.1 To provide perspective, the total U.S. valve purchases for this year will approach USD $12 billion across all industries.

Market Growth

The U.S. currently enjoys 20% of the municipal water market. The projected growth of this market is 3% per year. This percentage is low compared to the 4% growth project for the global municipal market and lower still then the projected growth of industrial water and waste-water valve market, at 7% per year, see Figure 3.

The high growth of the industrial market takes into account the zero liquid discharge and wastewater reuse.

Contributing Factors to Growth

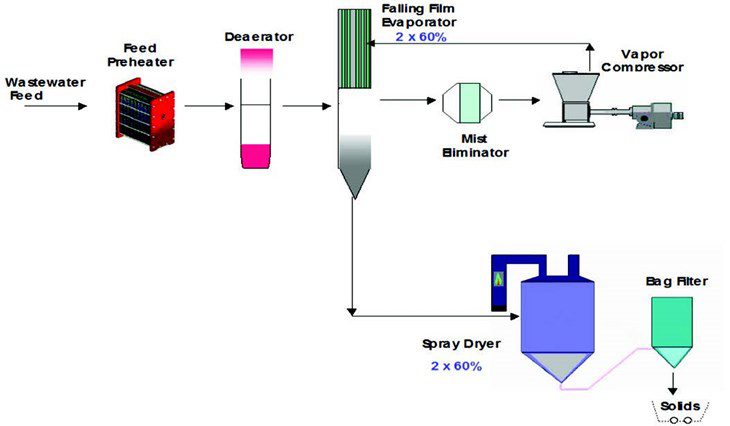

Wastewater reuse involves a bigger investment in high performance valves than normal wastewater treatment. It can involve evaporation and reverse osmosis which require special valve designs.

As freshwater scarcity, one of the most critical global challenges of our time, poses a major threat to economic growth, water security, and ecosystem health, water reuse is essential.

The public and industrial sectors consume substantial amounts of freshwater while producing vast quantities of wastewater. If inadequately treated, wastewater discharge into the aquatic environment causes severe pollution that adversely impacts aquatic ecosystems and public health. The challenge of providing adequate and safe drinking water is further complicated by climate change and the pressures of economic development and industrialization.

Recovery and recycling of wastewater has therefore become a growing trend in the past decade. Wastewater reuse not only minimizes the volume and environmental risk of discharged wastewater, but also alleviates the pressure on eco-systems resulting from freshwater withdrawal. Through reuse, wastewater is no longer considered a ‘pure waste’ that potentially harms the environment, but rather an additional resource that can be harnessed to achieve water sustainability.

Looking Forward

Communities across the country are incorporating water reuse into their water management strategies as a proven method for ensuring a safe, reliable, locally controlled water supply-essential for livable communities with healthy environments, robust economies and a high quality of life.

By 2027, the volume of recycled water produced in the United States is projected to increase 37% from 4.8 billion gallons per day to 6.6 billion gallons per day.

Areas of growth for water recycling include:

• Agricultural reuse

• Onsite non-potable water systems

• Industrial reuse

• Environmental restoration

• Potable (drinking water) reuse

• Produced water’ from oil and gas production

• Stormwater capture and reuse

One of the biggest present and potential uses is the power industry. In the U.S. municipal wastewater sources are convenient. The average power plant is within 70 miles of a municipal wastewater plant.

The market for valves for water and wastewater will be the aging infrastructure and water scarcity which is in part due to climate change but also do to previous water management practices.

References

1. Industrial Valves: World Markets published by McIlvaine Company

About the Author

Robert McIlvaine is the CEO of the McIlvaine Company which publishes Industrial Valves: World Markets. He was a pollution control company executive prior to 1974 when he founded the present company. He oversees a staff of 30 people in the U.S. and China.

http://www.mcilvainecompany.com