Valve World Americas Journal was pleased to speak with David Plum, president of marketing for fi nal control products at Emerson’s Automation Solutions business, about how the industry shifted its mentality, current thoughts about hydrogen strategies, new talent acquisitions, and how to think about the valve industry in the future.

By Stephanie Matas and Sarah Bradley

Every company, regardless of industry, battled challenges during the COVID-19 pandemic. Emerson has a very global valve manufacturing and service footprint across the globe with several facilities in North America, Latin America, Europe, Middle East, and Asia. The company had to face the pandemic on many fronts in each region of the world. “The most important thing for our valve management team was to protect our people and their families first, and then take care of our customers along the way,” said Plum. On a business level, adjustments were required by everyone as the industry worked toward recovery.

Overall, Plum said the valve industry has survived the pandemic extremely well. “As business levels fluctuated, valve industry companies were required to remain flexible and do the same. The responsibility we took for our own people and operations also translated to much of our supply chain to ensure it remained resilient,” Plum reflects, “The challenge of protecting people, supporting customers, balancing key technology investments, market strategies, reputation of our brands and meet promises was daunting.”

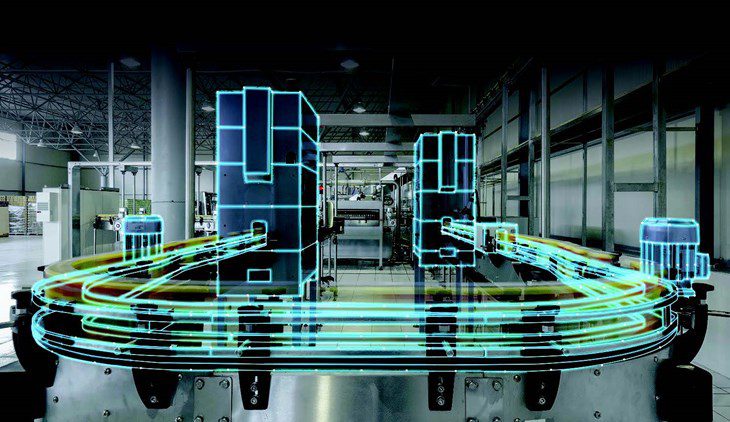

Creating a Digitized Portfolio

During the pandemic, Emerson continued to progress development of important technologies geared towards new application enhancement and digitization of key products. This includes next generation technology to digitize key functions of core products across isolation valves, pressure relief valves, control valves, and some actuation products.

Pressure relief valves (PRVs) are safe, reliable, and decidedly non-digital. Their function is critical, often serving as the last line of defense to avoid catastrophic process overpressure, so they rely on simple and proven mechanical mechanisms to achieve their purpose. These designs have remained largely unchanged for many years, and their lack of electronics makes PRVs very robust; it also however makes monitoring a challenge.

It is for this reason that many in the valve industry have recently introduced digital instrumentation to address monitoring issues and other roadblocks. Acoustic monitors with wireless communications can now also be mounted on the discharge piping of critical PRVs. For example, digital technology can detect situational leakage, indicating when a PRV lifts, how long it was open, and if it fails to seat properly.

“With PRV devices, a huge amount of work is being implemented to give end users the ability to monitor remotely,” said Plum. “There is a shift towards digital in our valve world, both on the technology side by improving field devices, and with the user experience. Digitization is changing things. Digital transformation may at first seem a bit ambiguous, but in the case of PRV monitoring, the benefits are significant, and the tools are relatively easy to obtain.”

Though companies have been conducting diagnostics and predictive analysis on valves for the last 20 years, there is still a large amount of stranded data. “One of the fi rst discussions we offer to users who want to review digital trends is to leverage the investment they have already made in digital valve controllers,” said Plum. If a client does not have the capacity or proficiency for valve diagnostics or data analytics, a valve connected services program has been established where users can use Emerson experts (on-premises or in the cloud) to analyze, determine priorities, and ready a material procurement plan for action. This way, customers are prepared with the information they need, when they need it.

Alongside investments in valve connected services and PRV monitoring, cyber-security is also a critical consideration for any digital investment

“We have been supplying valves for hydrogen applications for many years, but now the process opportunities have shifted. It is important that we understand what each hydrogen use case is, and whether there are any new considerations to be examined,” Plum commented.Applications for hydrogen are evolving and seeping into every facet of the supply chain. “There are emerging applications in the hydrocarbon industry where hydrogen is being produced, so it is important to be directly involved with users as they develop those processes and transport options, as they try to scale them,” he said. “It is essential to work with them to assure the control valves or critical isolation valves selected perform effectively, safely and reliably.”

Supply Chain Disruptions

Understanding how global valve manufacturers are managing disruptions to their supply chains can help all businesses structure their own responses, especially through the ongoing pandemic. Concerns mounted over depleting (or idling) stock and many companies feared they would not meet contractual obligations on time. “There was an inevitable backlog of orders for companies to handle, and there are situations where companies are still struggling to get the right materials, at the right time, in the right place,” said Plum. The company continues to work alongside its suppliers, assisting with materials procurement, raw machining, and other tasks to ensure they do not fall behind, in order to keep promises to customers and material fl owing despite unprecedented circumstances. Regionalizing the business was a leading factor toward success, with the fluctuation of volumes of material produced or manufactured in an area with high demand to shorten the lead time.

“One of our key metrics, or KPIs, is to drive how much material supply and manufacturing is located within a customer geographic region or country,” explained Plum. “We want that number to be very, very high to shorten supply chains and allow us to better control order fulfillment.” An ancillary benefit is if a shipping lane is blocked, then regional sourcing capability helps keep material fl owing to other plants where needed. However, the industry overall still faces challenges outside of the pandemic, including attracting newcomers to the valve industry and a shortage of skilled workers.

Acquiring Talent

Finding talented workers is always difficult, so companies like Emerson have implemented employee resource groups to help bridge the knowledge gap between existing engineers approaching retirement and those new students and engineers just entering the industry. “The valve industry overall has recognized a bleed of talent in recent years. The pandemic has caused additional churn with many people reevaluating commutes, different family member needs and overall work life balance,” said Plum. “When I started in the valve industry nearly 40 years ago, the way you went about pursuing and developing your career looked a lot different. Much of your life evolved around the dynamics of your career. That has all changed – much of it in good and important ways. But it creates new challenges for the employer – the on-boarding, development and retention of talent is even more important. People matter most and we have to listen to them and understand what matters to them, now more than ever.”

For this reason, senior leadership individuals have embraced the idea of investing in talent, development, diversity, equity, and inclusion, as these are often the reasons why people choose a career or company – potential employees want to understand company values.

“Creating a culture and environment where our employees know they have a voice that is heard by management has helped us recalibrate. It enables collaboration. We want to drive innovation that makes the world healthier, safer, smarter, and more sustainable – built around principles of protecting our planet and serving humanity as a whole,” said Plum. “A company culture that exists to develop and promote the best development of talent throughout the life of a career. Technology or business model innovation and best in class products will not happen without talented people. A company culture has to exist and evolve to make that happen – throughout the life of a career. Emerson has certainly been that place for me.”

Looking Forward

In recent months, Plum has witnessed maintenance, repair, and operations to keep running – in many cases service and repairs were delayed so recently we have seen an uptick in MRO spending,” said Plum. “In addition, some capital spending for large projects – renewables, LNG, alongside other clean energy – project, investments are growing.”

When asked about the future of the valve industry, Plum offered this: “So far, the role of valves has been critical to every industrial revolution, so the industry itself is part of critical infrastructure and I do not see that changing any time soon.” He continued, “Three years ago, we identified the major manufacturing trends that would have the most impact on the valve industry. In addition to digitalization, we looked at additive manufacturing, the emerging mid-tier segment, digital convenience, the growing concerns about climate change, and new ownerless business models.” “The investments we have made into additive manufacturing in our U.S. and Singapore operations is signifi cant. It is a similar story with digital transformation or the Industrial Internet of Things (IIOT) – our investments in technology are market-leading,” he said. “We are excited about the installations our customers have done for proof-of-concept in plants and refi neries to form critical clusters of final control applications – control valves, PRV’s, remote isolation valves, electric actuators, RFID tagging, etc. Now, as the industry pivots to more digitalization, the time is right to make that more mainstream across the plant. The use cases for valves are compelling. Now, we need to convince the customers to help them move forward.”

Plum also noted that ownerless business models and the emergence of mid-tier products may be seen in coming years. “An ownerless model is interesting. Imagine paying for valves on a use basis. It could be as straightforward as amortizing the expected total cost of ownership of the equipment over the plant lifespan with the supplier taking responsibility for condition monitoring and reliability. We haven’ seen it yet in the valve industry, but it’s certainly possible.”

More mid-tier product offerings in the market challenge customers to better understand the real ingredients of quality, as they compare the good, better, and best options available. “The best technology with the highest reliability and optimal performance standards may not be required for a basic, general-service duty. There is a minimum threshold however, that should not be compromised. The challenge with mid-tier products, in my opinion, is whether the proper scrutiny was put in place when the product was designed, selected, and produced,” explained Plum. “Quality and performance standards should never be ambiguous and certainly not sacrificed, along any point of the application severity continuum.”

The shift toward but digital convenience for clients is something Plum forecasts for the future, but the practicality of self-serve functionality for customers is still undefined. “Yes, digital convenience can reduce ‘friction’ or the back in forth time it takes for information exchange between manufacturer, channels and customer,” he said. “The challenge to overcome though, is that the valve industry is highly fragmented with technology choices that are both wide and deep. Technology is only as good as it’s application. We want to invite our customers into a rich and meaningful digital experience that is beneficial, creates value (speed/efficiency and knowledge) and ultimately protects them. We think this is still extremely important to customers.”

Lastly, on the topic of ESG/sustainability: “We are already responding to customers to help them better choose and use valve technology that has been developed specifically to support lower emissions toward their ESG and sustainability goals – Emission Control, Energy Efficiency, Energy Source Decarbonization, and Electrification. And we are doing it to help them leverage investments for new facilities or applications and when they pursue new revenue streams,” said Plum.

“These emerging trends reinforce the importance of what, we as the valve industry, have been doing for years – solving problems to make applications and processes perform and run as expected, to drive business outcomes and results,” he concluded. “The importance of bringing policy makers together with standard committees and experts will help us all better inform customers of needed changes, act more responsibly, competitively, and successfully.”