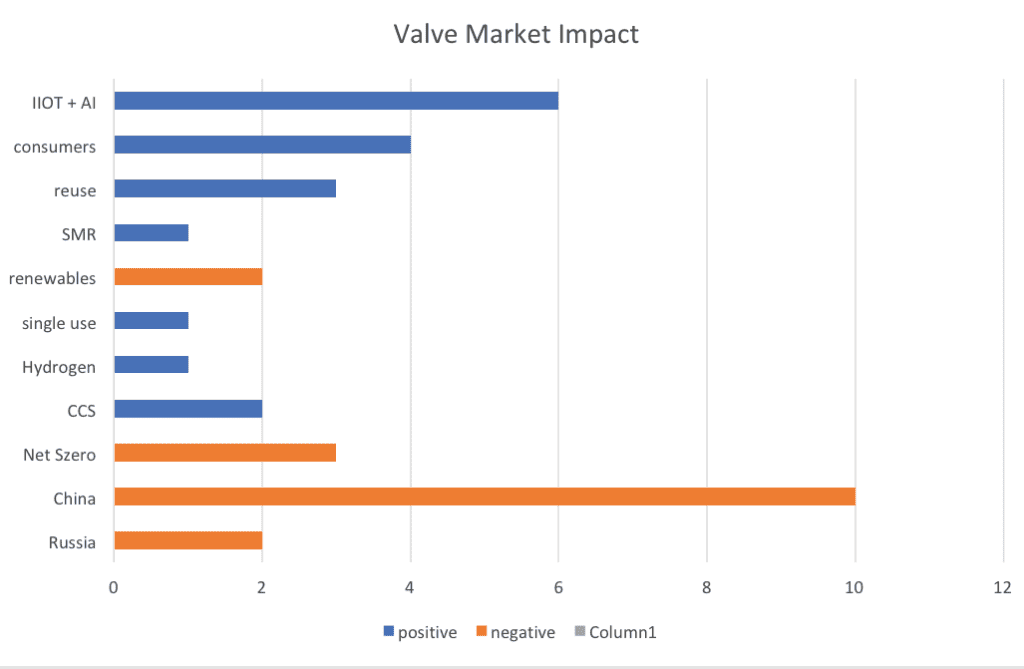

When considering the best approach to interacting with any market, the business strategy should include an analysis of all facts and factors on a periodic basis. The major driving factors should be continuously assessed. The valve market, specifically, will be shaped by several major factors while individual niche markets within this industry will be shaped by thousands of facts and factors.

By Robert McIlvaine, President & Founder – The McIlvaine Company

Primary Factors to Consider

The following is an overview of some of the most relevant factors to consider for the valve market, refer to Figure 1.

IIOT + AI

IIOT + AI are powerful factors that could boost valve company revenues by over 6%. However, if the valve companies are not proactive it could reduce the market. Purchasers want solutions which lower costs. The combination of valves and intelligent controls is a winner. The question is whether the control or valve manufacturer captures the additional revenues.

For example, the company Howden, which sells mine ventilating fans, bought an AI company that manages the flow control to keep the air in the mine below the lower explosive limit. This safety solution is a 24-7 revenue generator for Howden. In this case, the flow control supplier may lose revenue dealing with an OEM rather than directly with the customer.

IIOT + AI solutions revenue potential is even bigger in biopharmaceutical and semiconductor cleanrooms. There is a real advantage to assembling the valves, tubing, and other flow products in a cleanroom as they can be delivered to the customer in a clean state and ready to operate.

The cost of assembly in the customer’s cleanroom is very high. If the valve manufacturer rather than the tubing or other supplier is the solutions provider, revenues and earnings before interest, taxes, depreciation and amortization (EBITDA) can be increased.

This trend is also being observed in many non-clean applications. The advantages of pre-assembled valve systems are significant.

Consumers

The consumer is another big factor to consider. As the world population continues to grow, and the interest in specific commodities grows with it, a bigger investment in valves will be required. In general, the valve requirements increase with the increase in consumer goods expenditures.

Reuse

Some of the biggest valve potential is associated with the reuse of water, solids, and heat. Israel, for example, has been transformed from one with the lowest per capita water resources to one of the highest with their desalination program. Water reuse is expanding for residential, power, and industrial facilities.

The conversion of waste to usable products or energy, and heat recovery, are additional growth factors. If one power plant makes ethanol, and another facility grows tomatoes, both the heat and CO2 by-products can be utilized; this will require further investment in valves.

Small Modular Reactors

Small modular reactors (SMR) promise to revive the nuclear industry. They can be installed at many sites which were formerly coal-fi red generators. The concept of small generators also ties in with the advantages of heat recovery. Beneficial use is more likely at several small sites rather than a large one.

Renewables

Wind and solar will make steady inroads against technologies which use valves. However, over the next 15 years, the impact will not be immense. Offshore wind has a large potential due to the proximity. The problem with onshore wind and solar is the distance between the source and user and the necessity of the transmission lines. For a homeowner, the construction of a transmission line nearby is a game-stopper.

Single-Use

The biopharmaceutical industry is rapidly adopting single-use technologies including valves. The cleaning interval and various safety requirements for biopharmaceuticals cost manufacturers millions of dollars per month; this cost far exceeds the single-use option. For single-use applications, valves are made of plastic materials and are usually assembled in a cleanroom offsite. The assembly typically includes the tubing and possibly bottles or bags. Some valve suppliers offer complete packages. Mcilvaine estimates the single-use assembly market by 2027 will exceed USD $ 1 billion in the U.S. and USD $ 3 billion worldwide.1

Hydrogen

The valve potential for hydrogen extends to the manufacture of the hydrogen and then to its use to generate power or electricity. The near-term focus is on electrolyzers using renewable energy in remote locations. Wind, solar, geothermal, and hydro are all sources being utilized. Most of the hydrogen currently in use is used by industry, but in the long term, the hydrogen fuel cell could be a major source of mobile and stationary power. Direct fi ring of hydrogen in gas turbines is already being conducted.

Net Zero

The goal to achieve net zero CO2 emissions by 2050 imposes potentially negative consequences which could be eliminated by a more flexible approach. One of the risks is the closure of coalfired power plants and the removal of equipment and structures which could be used for Bioenergy with carbon capture and storage (BECCS). This is the one cost-effective carbon-negative technology. A carbon-negative technology can reduce CO2 concentration in the atmosphere.

The net-zero goal does not focus on the concentration in 2050. Once net zero is reached the concentration will slowly be reduced by natural forces. With carbon-negative technology, there is the argument that by waiting until 2060 and then using carbon-negative technology, 500 ppm could be accomplished.

Carbon Capture and Sequestration

Carbon capture and sequestration (CCS) can be carbon neutral or carbon negative. The Yara approach to using fossil fuels to create ammonia and then sequester the resultant CO2 is carbon neutral. Ammonia transport is a cost-efficient way of moving hydrogen from Australia to power plants in Japan.

BECCS is carbon negative. Forests in the S.E. U.S. take the CO2 out of the air and produce wood used to make millions of tons of pellets. They are shipped to the 4,000 MW Drax plant in the UK. BECCS could be widely used in S.E. Asia where many coal plants are presently under construction.

China

The largest negative factor to consider is Chinese aggression. An attack on Taiwan would destroy 80% of the world’s advanced chip manufacturing capability.

Many international valve companies operate in China, while many others depend on Chinese suppliers. China is also a large market for severe service and critical valves. It is in the interest of both nations to restore trade relationships.

Summary

There are several major factors that will continue to impact the valve market. Business strategy should be adjusted from month to month based on the latest assessment. The magnitude and likelihood of change are too great to ignore for any length of time.