Artificial Intelligence (AI) is changing the valve industry much faster than at any time in history. Valve operators are able to find customized products that reduce cost of ownership significantly better than the standard versions. If the valve industry leads rather than follows, both suppliers and customers will achieve higher profits.

By Robert McIlvaine, President and Founder – The McIlvaine Company

It is no longer acceptable to forecast just the butterfly valve market in Asia for the chemical industry. It is now necessary to forecast the segment where triple offset butterfly valves are the best choice. The chemical industry involves a wide variety of applications, so general forecasts are not very valuable. One segment is coal to chemicals. In Asia, much of the plastics start out as coal. China is the largest producer of chemicals from coal, while Indonesia is embarking on a robust program.

A valve supplier determining whether to pursue this niche of triple offset butterfly valves for the coal gasification market must first refine the specific application. The coal gasification process is not only the basis of coal to chemicals but of syngas used to replace liquefied natural gas (LNG). The production of rare earths as part of the coal gasification process has now gained interest and funding.

Sinopec is continuing to pursue coal gasification to reduce LNG imports. In addition, small-scale LNG systems where coal is gasified and then liquefied are trucked to small power plants.

Both GE and Siemens were very active in supplying coal gasification plants in China 20 years ago. Robert McIlvaine, President and Founder of The McIlvaine Company, emphasized to Siemens that their prescrubber downstream of the gasifier was collecting HCL and rare earths and was the perfect stabilizer for the rare earth process. McIlvaine cites his experience with coal and sulfuric acid plants to support this contention. So, it is likely then that new research will support earth processing as a major advantage of coal gasification. Coal gasification is also the basis of blue hydrogen, including CO2 sequestration.

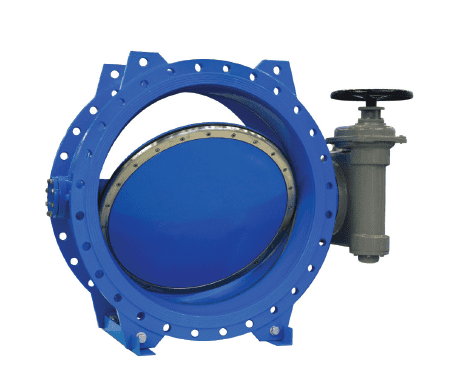

Triple offset butterfly valves are a specialized valve design well-suited for cryogenic liquid applications like CO2 liquefaction.

The key features include:

- Tight Shutoff

- Reduced Torque

- Reduced Seat Wear

- Cryogenic Compatibility

These valves help enable the safe and efficient handling of liquid CO2 in liquefaction, storage, and transport applications. Their triple offset design makes them well-suited for the challenges of cryogenic service.

The decision to pursue a special market such as coal gasification in China must be shaped by the competitive situation. Offshore manufacturers have been encouraged to set up manufacturing facilities in China. Approximately 75% of industrial valves used in China are manufactured locally.

Chinese triple offset butterfly valve producers include:

- Neway Valve (Suzhou) Co., Ltd.

- Zhejiang Yuanda Valve Manufacturing Co., Ltd.

- Shanghai Valve Factory Co., Ltd

- Henan Yuxin Valve Co., Ltd.

- Wuxi Pekos Valve Co., Ltd.

- Jiangsu Shentong Valve Co., Ltd.

- Wenzhou Xingdu Valve Co., Ltd.

International triple offset butterfly valve producers include:

- Emerson Electric Co. (USA)

- Velan Inc. (Canada)

- Bray International, Inc. (USA)

- Cameron, a Schlumberger company (USA)

- HOBAS Valve GmbH (Germany)

- AVK Holding A/S (Denmark)

- Babcock Valves (Spain)

- IMI plc (UK)

- Crane Co. (USA)

Each market opportunity should be assessed based on the ability to reduce customer cost of ownership and at the same time achieve high EBITDA despite competition.

This involves assessment of manufacturing, distribution, and triple offset butterfly comparisons to competitor offerings. In cases where distribution may not be as strong as competitors, it may be necessary to focus on triple offset butterfly sizes larger than 26 inches and possibly even the very large special valve sizes. Certain applications have very severe abrasion potential, and this may make a specific design a better option.

Decisions can be made by energy companies such as Shell and Sinopec, who own their production facilities. Sinopec is based in China and is the world’s largest combined chemical and oil and gas company; however, European-based Shell has a major presence in coal gasification in China. Siemens and GE supply complete gasification systems and have their proprietary gasifier designs. Both have many installations in China.

KBR is a U.S.-based engineering company with a proprietary gasification system. They have large systems operating in China, as well as ongoing projects. KBR has arrangements with equipment suppliers in the Chinese market to ensure the products are available as needed. The opportunities for triple offset butterfly valves are complex and an aggregate of specific niches. Coal to chemicals is a niche involving coal gasifiers, but this leads to other niches such as coal to syngas and coal to blue hydrogen. Smaller TOVs are available through stocking distributors and may limit competition, but large sizes shipped from the factory can be an advantage as factory inspections are often stipulated.

Political dynamics are another variable. A large part of the market is in Asia, so the Chinese government’s policies will be variable. The decision to pursue a particular opportunity must account for all these factors. Fortunately, with AI, information on all these variables is available.