Low-cost manufacturing countries of the world will be utilizing an increasing percentage of the world’s valves. Traditional manufacturers are challenged by the low selling prices and lack of access. This lack of access is mostly due to the inattention of the large valve suppliers. But as these countries use a larger percentage of the world’s valves, it is desirable to address the increasing market share rather than neglect these markets.

By Robert McIlvaine, CEO – McIlvaine Company

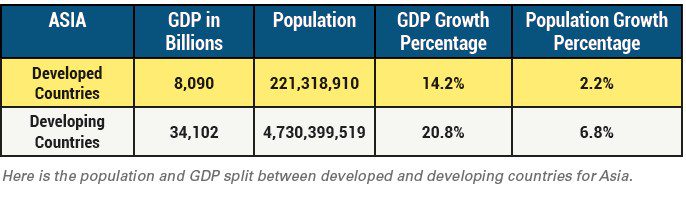

Population and GDP are two of the best indicators of future valve demand. The population of Asia is now 4.81 billion and will increase to 5.05 billion by 2035. The population of Africa is now 1.53 billion but will increase to 1.89 billion by 2035. At that time, it is estimated that these two areas will have 78% of the world’s population.

As of today, no African countries are officially classified as “developed” according to global economic and human development metrics like those used by the United Nations (UN), World Bank, or International Monetary Fund (IMF). African nations are generally considered “developing countries” due to challenges such as lower income levels, less industrialization, and human development index (HDI) scores that are typically below those of developed nations. South Africa is closer to being a developed country than its neighbors as it has abundant natural resources and is a leader in the mining of certain minerals. It rose to prominence by creating its gasoline from indigenous coal reserves. Due to tourism, Seychelle and Mauritius are also close to developed, but not industrial maturity. In Asia: Japan, South Korea, Singapore, Hong Kong, Taiwan, and Israel are considered developed countries.

In these countries, there is also a problem with providing service due to the lack of local personnel and higher hourly rates. This aspect will change steadily as remote monitoring allows remote personnel to operate very effectively and avoid travel expenses. Performance monitoring allows replacement valve needs to be predicted well in advance and eliminate the need for local stocking. Also, the performance monitoring allows the distant supplier to better understand the local needs and provide valves which deliver the lowest total cost of ownership despite higher first cost.

For valve manufacturers these developing markets not only promise large revenues in the future but technological advancements of general value. With remote O&M, every valve operation will instantly be accessible. Instead of being a handicap, the lack of skilled workforce will cause these locations to lead in Automation, Remote Maintenance and Operation (AROM).

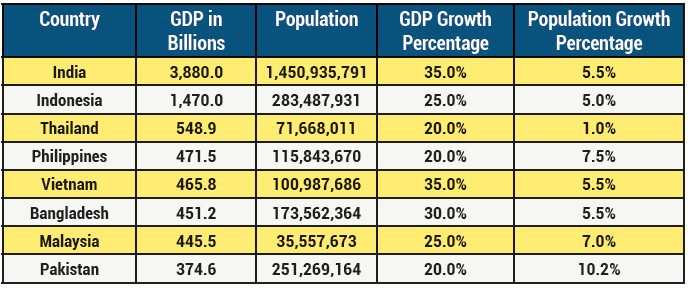

Some of the fastest-growing economies in Asia include India, Bangladesh, Vietnam, Philippines, Myanmar, Cambodia, and Laos. India continues to show robust growth rates with a diverse economy and significant growth in the technology and services sectors.

Here is a selected list of countries with high GDP and population growth:

The Impact of AI on the African and Asian Valve Markets

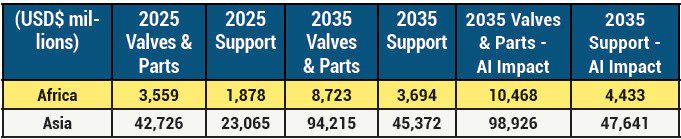

AI (Artificial Intelligence) could have a disproportionately large impact on African and developing Asian valve markets. Here are present forecasts for valves including support through 2035:

However, AI could have an even bigger impact on the developing countries in Asia and Africa. Since it impacts all of Africa, the 2035 numbers could be 20% higher than the present effort. A similar impact on developing countries in Asia would boost the total Asia impact to 5% larger by 2035.

McIlvaine forecasts through 2035 already take into account a big boost from AI and the incorporation of AROM (Automation, Remote Operation, and Maintenance). There is no doubt that developing Asia and Africa will be quick to embrace AROM, but we also believe that as what happened with land phones and credit cards, developing countries will leapfrog these advances and move straight to AROM.

We have also prepared an alternative forecast to take into account this phenomenon.

This special boost for AROM and developing countries would have an impact of increasing valves and support by 25% in 2035. Since all of Africa is developing this results in a 20% larger number in 2035. In the case of Asia, we have a smaller percentage which is developing. We have included China as developing. Even though there is a 20% impact on the developing Asian countries, there is only a 5% impact on all of Asia.

In January of 2025 there was more AI development, which indicates that the amount of energy required for AI will be substantially less than anticipated. The result is that AROM may be embraced without the feared limitations on the lack of energy to operate the software. The U.S. owes its great progress to the highly educated workforce. With AROM, this asset may be effectively utilized in the developing countries.

AROM will generate reliable data on lowest total cost of ownership decisions. This will be the data used by the mix of local and international decision makers who will select the valves. Those with the results of performance monitoring in the exact application can most effectively leverage this intelligence to secure orders.