By Resolute Research

Petrochemical Projects in the Americas

In the Americas, there are approximately 100 petrochemical plants currently in various stages of development – be it under construction, in the commissioning, or planning process. These plants will focus on a range of petrochemical products, including methanol, ethylene, polyethylene, propylene, polypropylene, ammonia, and urea.

When looking at the potential capacity additions, the methanol plants represent about 35% of all new petrochemical capacity currently planned to come online in the next five-year period (i.e., by the end of 2026) – by far the largest share, followed by polyethylene, ethylene, ammonia, urea, propylene, and other petrochemical capacity additions.

A large majority of these planned plants – approximately 80 – are located in the United States. The plants are mainly being planned for the southern states, such as Texas and Louisiana; however, several will be located in more northern states like Pennsylvania, Illinois, and West Virginia.

Canada also has a significant number of proposed petrochemical plants, equalling roughly 14 projects.

Latin America will also see one new major petrochemical project in the next few years: the Gas y Petroquimica de Occidente Topolobampo Complex in Mexico. This project, located in the Mexican state of Sinaloa and the city of Topolobampo, is made up of three separate plants, each focusing on a different petrochemical product: methanol, ammonia, and urea. The total combined capacity for the three plants is expected to be 2.520 mtpa (million tons per annum). These plants are scheduled to come online in 2023.

Methanol: Projects and Trends

Methanol plants are among the most natural gas-intensive industrial end users and require natural gas both as a feedstock and for process heat.2

Methanol has several energy-related applications. Pure methanol can be used directly as an alternative transportation fuel or blended into motor gasoline abroad to increase combustion efficiency and reduce air pollution.2

The total operating U.S. methanol capacity is presently around 8 mtpa. However, if all of the U.S. methanol projects currently under development materialize, this capacity will more than triple, increasing to approximately 27 mtpa by the end of 2026.

In Canada, methanol production capacity is planned to increase nearly sevenfold, from the current 0.6 mtpa to approximately 4 mtpa by the end of 2025.

Of the 100-odd petrochemical plants currently planned in the Americas (U.S., Canada, and Latin America), two methanol plants are the largest projects – both in terms of production capacity and, by extension, capital expenditure.

NW Innovation Works St. Helens Complex

The NW Innovation Works St. Helens Complex, located at the Port of St. Helens in Oregon, has a planned start date of 2023. The plant has an expected total capacity of 3.6 mtpa, and the total capital expenditure is expected to be approximately USD $2.2 billion. The project will focus on methanol and will utilize the JM Davy Methanol Technology.

Johnson Matthey (JM) is one of the world’s leading methanol technology and catalyst providers, with over half of the world’s licensed methanol plants based on their DAVY™ technology.3 The JM flowsheet for producing methanol is based on three key steps: reforming – converting natural gas to synthesis gas (syngas – CO, CO2 and H2); synthesis – converting syngas to methanol (CH3OH); and distillation – product purification.3

Nauticol Energy Grande Prairie Complex

The Nauticol Energy Grande Prairie Complex, located in Grande Prairie, Alberta, Canada, is expected to become operational in 2024. With a total capital expenditure of USD $1.6 billion, in its first year, the total capacity will be 1.0 mtpa; following an expansion plan that will become operational in 2025, the plant will have an expected total capacity of 3.4 mtpa. Similar to the NW

Innovation Works St. Helens Complex, the project in Alberta will also focus on methanol, but will utilize the Haldor Topsoe Methanol Technology.

Topsoe-designed methanol production plants combine advanced syngas generation and syngas-to-methanol processes with high-activity methanol production catalysts and comprehensive services. They are designed specifically to help maximize yields and drive down costs. The demand for methanol is driving producers to seek the greater yields and economies of scale that only larger plants can provide. As a result, 10,000 mtpd methanol plant layouts will likely soon be the new industry benchmark for large-scale production.4

This particular plant is quite interesting because it will be a “low-carbon” plant, thanks in large part to a Carbon Capture and Sequestration (CCS) solution that could capture and store up to one million tons of CO2 each year from Nauticol’s planned facility. Mitigation of CO2 emissions in the oil & gas and petrochemical industries is a priority in today’s world, so it is possible that many more plants will utilize a CCS solution going forward.

Opportunities for Valve and Actuator Sales

Project activity in the petrochemical industry will generate significant demand for valves and actuators, which will be in addition to valve and actuator expenditure for MRO (Maintenance, Repair and Overhaul) of existing facilities.

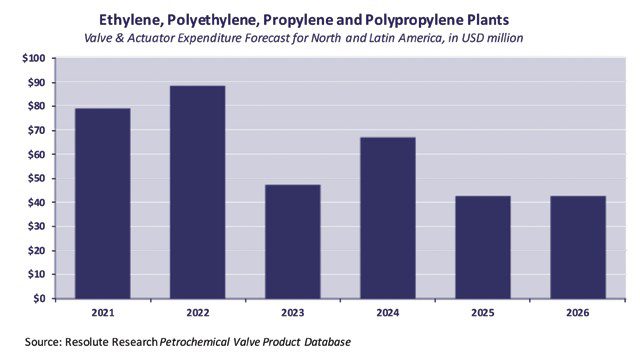

In total, around 10 mtpa of new ethylene, polyethylene, propylene and polypropylene capacity currently under various stages of development is planned to come online within the next five years (between 2022 and the end of 2026). All these capacity additions are planned in the U.S. and Canada. If fully materialized, the combined valve and actuator expenditure for these new-build plants, and MRO activities at existing plants in both North and Latin America, would reach nearly USD $290 million (see Chart 1), according to market research and consultancy firm Resolute Research.

What is Methanol?

“Methanol is one of the four critical basic chemicals – alongside ethylene, propylene and ammonia – used to produce all other chemical products. About two-thirds of methanol is used to produce other chemicals, such as formaldehyde, acetic acid, and plastics. Methanol use for the production of polyethylene and polypropylene in particular has grown significantly, going from almost zero ten years ago to 25 Mt in 2019. The remaining methanol is mainly used as a fuel for vehicles, ships, industrial boilers and cooking.

“Methanol’s use as a fuel – either by itself, as a blend with gasoline, for the production of biodiesel, or in the form of methyl tert-butyl ether (MTBE) and dimethyl ether (DME) – has also grown rapidly since the mid-2000s. Most methanol is currently produced from natural gas or coal, with estimated annual life-cycle emissions of 0.3 Gt CO2, around 10% of the total chemical and petrochemical sector’s CO2 emissions. Addressing emissions from methanol production is therefore a key component of the decarbonisation of the chemical sector and could contribute to the transport sector where the methanol can be used as a fuel.”

Source: Irena And Methanol Institute (2021), Innovation Outlook: Renewable Methanol.

REFERENCES

1. Irena And Methanol Institute (2021), Innovation Outlook: Renewable Methanol, International Renewable Energy Agency, Abu Dhabi. Accessed at: https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2021/Jan/IRENA_Innovation_Renewable_Methanol_2021.pdf

2. Ameen, Naser and Kristen Tsai. “New methanol plants expected to increase industrial natural gas use through 2020.” EIA: U.S. Energy Information Administration. Accessed at: https://www.eia.gov/todayinenergy/detail.php?id=38412#

3. “Methanol process.” Johnson Matthey, 2021. Accessed at: https://matthey.com/en/products-andservices/chemical-processes/licensed-processes/methanol-process