The Houston Port region’s make up is so unique that there is no blueprint out there showing how to improve its economic development activities/assets, transportation infrastructure, workforce development entities, and investment protections. For this reason, Economic Alliance has established itself as the convening entity in identifying, prioritizing, and promoting issues of Houston Port region significance.

Economic Alliance’s efforts in economic development and advocacy continue to eliminate unnecessary procedures so that representatives, government agencies, associations, residents and members/businesses can work together seamlessly. Its strategic approach directly impacts the growth and maintenance of the most sought after region in the world for petrochemical, manufacturing, maritime and logistics operations.

By Chad Carson, Vice President Economic Development – Economic Alliance Houston Port Region

The economic engine that is the Houston Port region is not only unique to the region but also the state and national economies. It is one of, if not the largest, growth engines of economic opportunity anywhere in the world. The ship channel is constantly considered a priority based on the economic impact and the unique needs that come along with sustaining investment activity. The economic benefit in the Houston Port region is nearly 7-fold regarding businesses and workers:

In Texas

• It generates USD $339 billion in economic value,

• It sustains 1.3 million jobs, and

• It generates USD $5.6 billion in state and local tax revenue.

In the U.S.

• It generates nearly USD $802 billion in U.S. economic value,

• It supports 3.2 million jobs, and

• It provides USD $38 billion in tax revenue.

Through economic development activities (job creation, job retention and capital investment), Transportation/Infrastructure, Public Policy, Workforce Development, Quality of Life, Events/Networking, Economic Alliance aims to market and grow a vibrant regional economy.

Port Activity and Its Impact

The 52-mile long Houston Ship Channel is a vital economic engine for the Houston region, the State of Texas, and the U.S. Last year, the USACE ranked Port Houston as the busiest port in the nation – the channel handles as much vessel traffic as the three largest U.S. ports combined.

• Today, the ship channel continues to be one of the busiest waterways in America with more than 8,000 vessel calls and 200,000 barge transits annually.

• There are roughly 60 deep water arrivals and departures in the Houston Ship Channel each day and about 80 ships in port, according to Port Houston.

• The channel is lined by about 200 private terminals and eight public terminals. The public terminals are operated by Port Houston. The port handles more vessel traffic than the next three largest U.S. ports combined: Los Angeles, Long Beach and New York/New Jersey, according to Port Houston.

Cargo volumes across Port Houston’s docks are continuing to shatter records. The public container terminals recorded its highest cargo volume ever in August 2021 and there has been a dramatic increase in import steel, and other general cargo commodities handled through the multipurpose facilities. Port Houston also witnessed an extended peak holiday season for containerized cargo; the elevated levels occurring in the supply chain are expected to continue well into 2022.

The unprecedented surge in import volumes has created significant challenges across the nation and Houston is not immune to current disruptions in the global supply chain. However, Port Houston remains closely engaged with customers, ocean carriers, stevedores, labor, truckers, and all other industry partners to seek solutions to maximize the opportunities to keep freight moving efficiently.

• TEU volumes are up in Houston 15% in ’21 over ‘20. The bigger trend started about 6 years ago with labor disruptions in LA/LB. Since then, Houston has seen Asian imports go from 0% to 37% of all containers. This is risk mitigation from shippers tired of the delays on the West coast.

• Houston recently hit 3 million TEU’s in ’19 and will hit 3.5 TEU’s this year. 16,000 TEU in one day this past week is a record for the Port.

• Houston is not immune to delays (the port is indicating 2–4 day delays over what is considered normal of 24 to 48 hours). This is a result of manpower shortages, and chassis shortages, given the number of containers that are in backlog.

One advantage in all this activity is that Houston is an exporting port and that means the movement of containers out and back to China. This is a distinct advantage over other US Ports who are not returning containers to mitigate a worldwide shortage.

Port Houston Growth & Improvements

Due to COVID-19, individuals who would generally be spending funds on vacations, going out to restaurants, and buying services, began spending more on goods. The result of these actions is a surge in imports which puts a strain on the supply chain; it has been filling up terminals, and extra storage space. Over the last 3 years more than 170 acres have been delivered by Port Houston for storage and it is currently full. Demand for imports has also been affected and is at an all-time high in Texas, creating a surge in leasing activity, construction and expansion of e-commerce warehouse distribution space in the Houston area.

Maritime Infrastructure Improvements to Keep the Houston Port Region Competitive

As the advocate and local sponsor of this crucial federal waterway, Port Houston is partnering with the U.S. Army Corps of Engineers as well as private industry on a plan to expand the channel at an accelerated pace. With the help of those partners, Port Houston will begin work this year:

- The Houston Ship Channel expansion – Project 11/USD $1Billion – will widen the channel by 170 feet along its Galveston Bay reach, from 530 feet to 700 feet. It will also deepen upstream segments to 46.5 feet, make other safety and efficiency improvements, and craft new environmental features. The channel is about 40 feet deep and 300 to 400 feet wide for most of its 52-mile length.

In October, Port Houston awarded the first dredge contract for the Houston Ship Channel Expansion – Project 11.

- This first project will dredge 11.5 miles of the 52-mile channel, widening a major portion of the Galveston Bay reach from 530 to 700 feet. The work also includes the construction of a new bird island and oyster mitigation. Port Houston estimated that it will take three to four years to complete most of the work.

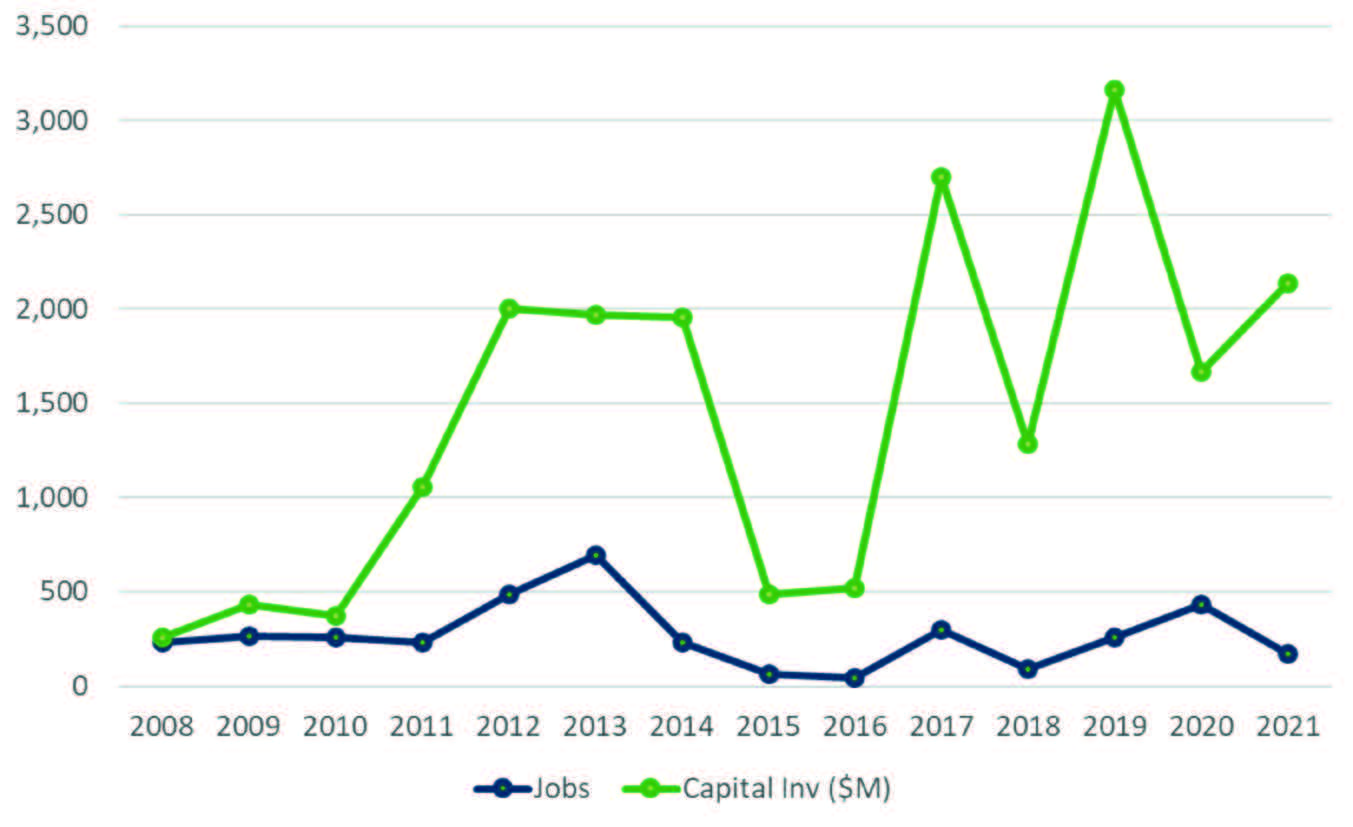

EA Jobs and Capital Investment by Year

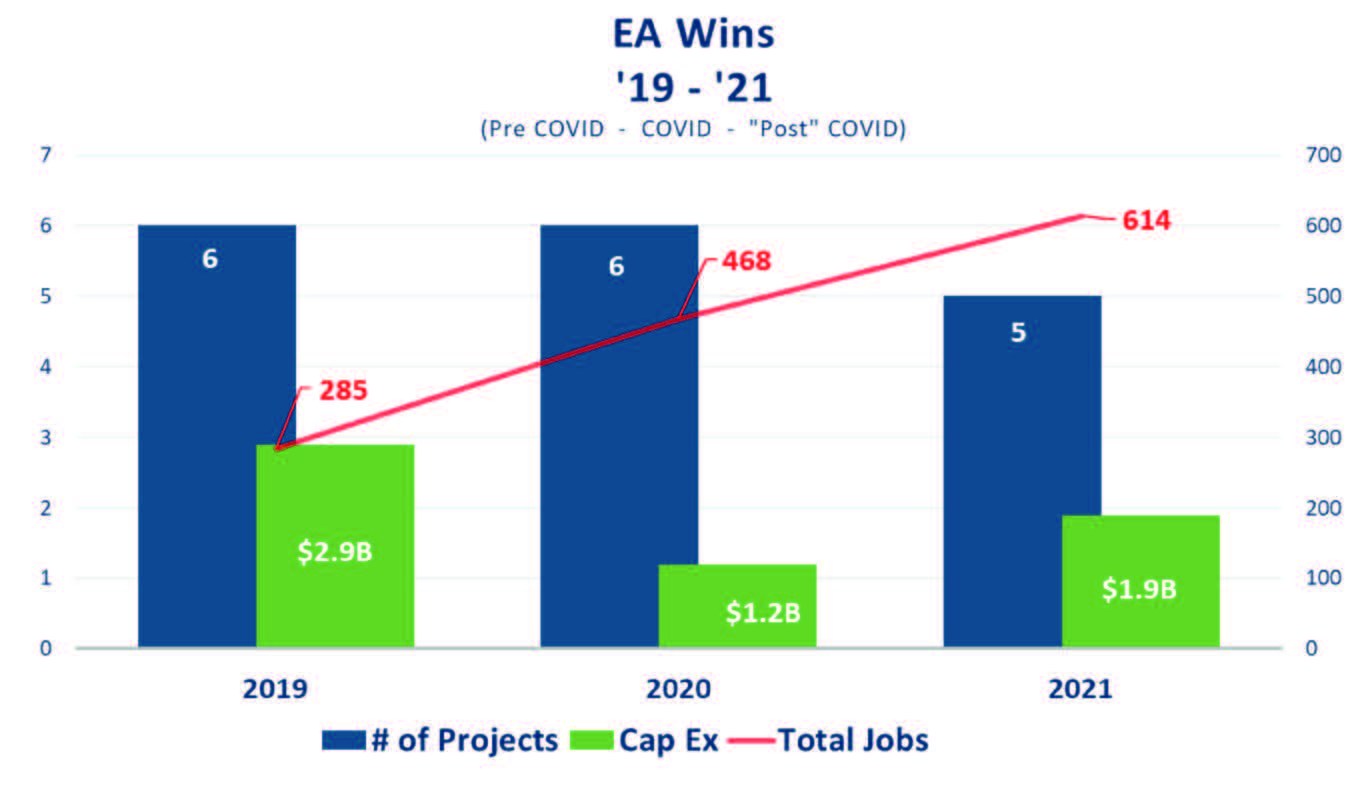

Between 2019 and 2021 Economic Alliance has had 74 economic development wins which act as proof that they provide a professional relationship to navigate the multiple facets of the expansion process in the Houston Port region. These services may include:

• Conducting real estate searches of existing and greenfield locations for expansion/relocation

• Participation and coordination of site-selection trips/briefings and orientations of the Houston Port region/Harris County

• Facilitate access to data (via partners) on key business factors that highlight the Houston Port region as a destination for investment and job creation

• Provide guidance in evaluating and applying for State and Local incentive and workforce programs

• Advocacy for projects on issues pertaining to permitting and regulation with State and Local entities

• Mobilization of our key board members, allies, partners to ensure project success

2021 Economic Development Wins

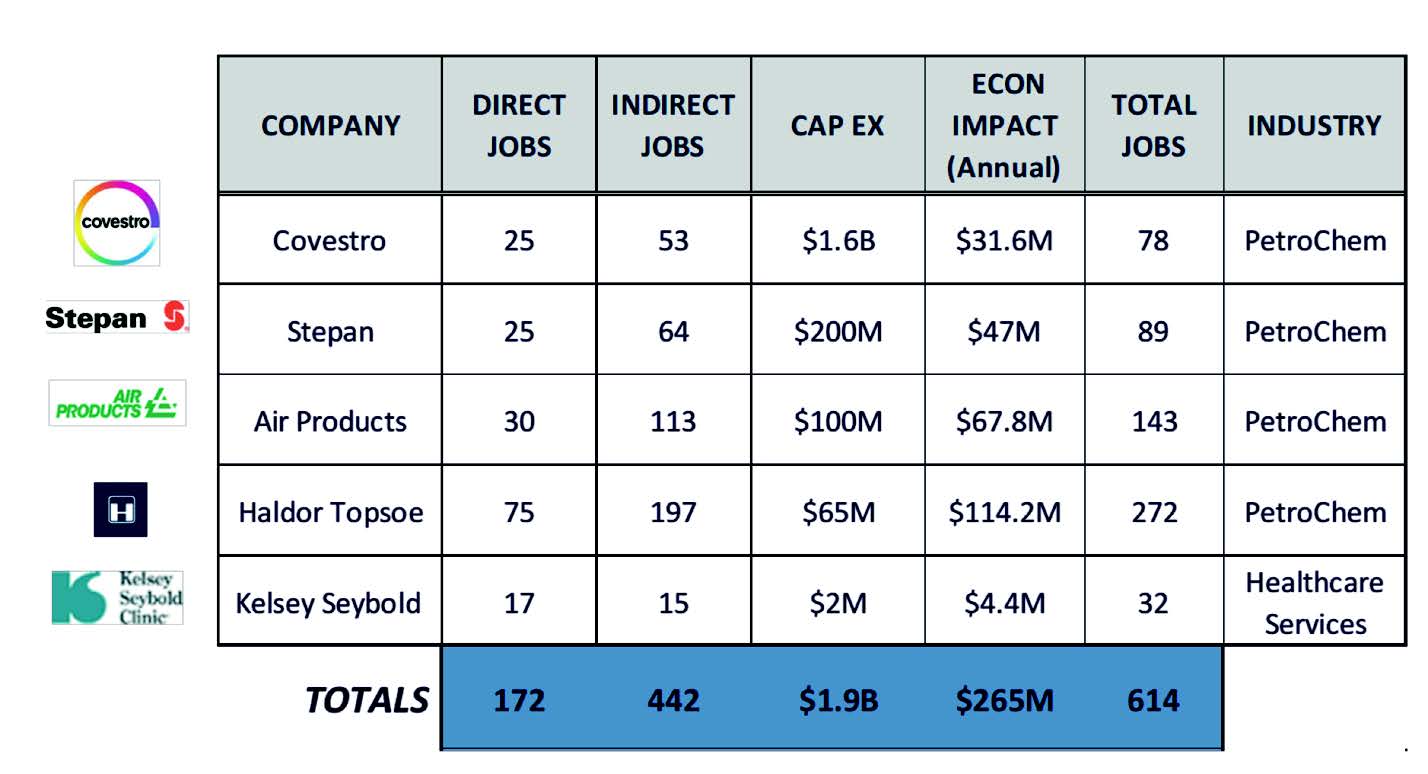

In 2021, Economic Alliance supported 5 companies that comprise the most influential energy and trade corridors in the world to create livable wage jobs and secure asset investments to solidify our economic base.

These 5 wins consisted of – USD $1.9B in one-time capital investment – 600 total jobs created – USD $265M in annual economic impact. The industry make-up of the wins was as no surprise dominated by petrochemical projects. The below chart and narrative highlights the 2021 expansions Economic Alliance was involved in:

• Covestro – Constructing a USD $1.6B manufacturing unit for polyurethane and polycarbonates at its existing site in Harris County. The investment will create 25 new job opportunities paying in excess of USD $60k. Construction is anticipated to start in 2025. Economic Alliance facilitated the Chapter 313 discussion with Goose Creek ISD.

• Stepan Corporation – Constructing a USD $200M alkoxylation surfactant manufacturing plant in Harris County on undeveloped land at the location of its existing idle Pasadena plant. The new facility will produce products for laundry, cleaning, agricultural, insulation, paints and coatings, creating 25 new job opportunities paying in excess of USD $60k. Construction is anticipated to start in the third quarter of 2021. Economic Alliance facilitated the Chapter 313 discussion with La Porte ISD.

• Air Products – Constructing a USD $100M liquid hydrogen plant at its La Porte industrial gas facility to meet increasing demand from hydrogen fuel cell vehicle users and various advanced manufacturers. The investment will create 25 new job opportunities. Construction is anticipated to start in March 2022. Economic Alliance facilitated permitting discussions with Harris County to help meet the company’s investment timeline.

• Haldor Topsoe – Investing USD $65M to build a hydro processing catalyst plant at the company’s existing Bayport production site. The plant will increase production capacity to meet increasing demand, both in traditional refining and for use in the production of renewable diesel and jet fuel. The investment will create 65 new job opportunities. Economic Alliance facilitated discussion with Harris County to approve a property tax abatement. The facility is expected to be fully operational in the first half of 2023.

• Kelsey Seybold Clinic – Investing USD$2M in the retrofit of a 7,500+ Sq. Ft. healthcare clinic along the Beltway East in Houston’s North Ship Channel. The healthcare facility will create 17 new jobs and offer providers focused in family and internal medicine. Services will range from imaging, laboratory diagnostics and immunization. The Precinct 2 Commissioner made Economic Alliance aware of the deficiencies in healthcare providers in the North Ship Channel and in turn Economic Alliance made the connection with Kelsey Seybold representatives.

Transportation Infrastructure Improvements to Keep the Houston Port Region Competitive

For several years the Economic Alliance has convened a Transportation Infrastructure/Mobility taskforce. The group is a collection of local/state elected officials, Port Houston, petrochemical association partners and private sector members. The mission has been to deliver TXDOT and key leadership a prioritized transportation/infrastructure project list based on stakeholder consensus and critical investment need. Project priorities have been based on:

• Impacting safety, mobility efficiency and environmental concerns related to the SH146/SH225/610/I10 transportation corridor.

• The need to facilitate economic opportunity through the acknowledgment of Port Houston’s unprecedent growth that has made it the nation’ busiest port. The port’s economic impact supports 1.3 million jobs statewide, over USD $3M nationally and is forecasted to continue to grow as it supports the nations supply chain needs.

• Specific projects that will enhance current/future committed private sector and public transportation mobility investments. Specifically, over the last several years, the Houston port region has seen USD $50B in manufacturing expansions, Port Houston’s $1B commitment to widen and deepen the Houston ship channel, and state and local investment to construct the $2B Beltway 8 bridge and expansion of SH146.

PEL Studies

• I-10 East Expansion that includes the San Jacinto River Bridge

• 225 & 610 Preliminary study at upgrades and expansion

Design and Work Underway

• 146 Expansion and Widening/Fairmont to Red Bluff

• Beltway 8 Bridge and Direct Connectors

Ultimately, the taskforce is making certain the Houston Port region is connecting mobility/safety/environmental issues, economic opportunity, and our unprecedented industry growth with current and future transportation/infrastructure projects.

Public Policy Advocacy

With its members input, Economic Alliance works to improve the economic development assets, transportation infrastructure, workforce development entities and investment protections. For this reason, Economic Alliance has established itself as the convening entity in identifying and promoting issues of Houston Port region significance.

Economic Alliance’s efforts continue to eliminate unnecessary procedures so that representatives, government agencies, associations and its members/businesses can work together seamlessly. Its strategic approach directly impacts the growth and maintenance of the most sought after region in the world for petrochemical, manufacturing, maritime and logistics operations.

This unified approach is positively recognized and is viewed as a means to identify and prioritize policy/projects that will have the most impact on the Houston Port region.

Goals of the Houston Port region advocacy:

1. Communicate the region’s legislative priorities clearly and succinctly.

2. Obtain state/federal funding for local projects.

3. Advocate for legislation or policy changes that will benefit the Houston Port region.

4. Support our legislators by meeting with their community leaders/constituents to understand projects and issues relevant to the Houston Port region.

DC Trip 2021

A leadership team organized by Economic Alliance travelled to D.C. (Oct 26-27) and was led by Local Elected Officials, Business Organizations & Associations, Educational Partners, Port Houston Advocates and the Private Sector.

-

- Over a period of two days, the 21-person Economic Alliance Leadership Team conducted 25 meetings with Senate, Congressional and Association representatives, along with a Congressional Dinner to discuss the Houston Port regions Federal Policy Priorities

3 – U.S. Senate Meetings

1. Sen. John Cornyn TX

2. Sen. Ted Cruz TX

3. Sen. Roger Wicker MS

13 – Congressional Delegation Meetings/Texas

1. Dan Crenshaw TX-2

2. Randy Weber TX-14

3. Sylvia Garcia TX-29

4. Brian Babin TX-36

5. Lizzie Fletcher-TX-7

6. Jody Arrington TX-19

7. Eddie Bernice Johnson TX 30

8. Kevin Brady TX-8

9. Troy Nehls TX-22

10. John Carter TX-31

11. Michael McCaul TX-10

12. Michael Cloud TX-27

13. Collin Allred TX-32

7 – Congressional Delegation Meetings/U.S.

1. Kelly Armstrong ND

2. Bob Gibbs OH

3. Frank Pallone NJ

4. Troy Carter LA

5. Bobby Scott VA

6. John Curtis UT

7. Bruce Westerman AR

3 – Major U.S. Associations focused on Petrochemical, Manufacturing and Maritime

1. American Fuel & Petrochemical Manufacturers

2. National Association of Manufacturers

3. United States Maritime Administration

31 – Congressional Dinner Attendees/

3 Members of the Texas Congressional Delegation

This strategic and unified approach is positively recognized at the federal level and is viewed as a means of assisting our federal representatives to identify and prioritize policy/projects that will have the most impact on the Houston Port region.

The Economic Alliance has been encouraged to continue this collaborative

approach and build upon the relationships and communication channels established with our federal representatives. The trip has not only successfully organized high-level meetings with access to key decision makers but has also given participants a clear understanding of regional priorities and invaluable connections.

Workforce Development

Economic Alliance provides a forum that facilitates the promotion of work-force development initiatives to address the growing skilled workforce gap. Our activities are focused on market high paying careers in the petrochemical, maritime, logistics, and construction industries to local students in order to close the skilled workforce gap and connect opportunities.

• Leveraging partnerships with EHCMA and 9 community colleges to recruit and train a qualified workforce that is needed in the Houston Port region

• Identified and prioritized with industry the high-demand, high-paying careers supporting the petrochemical and maritime industries

• Lead activities to directly market career paths and job opportunities to address attrition, skill enhancement and demand to potential candidates

In 2021, Economic Alliance connected with 5,000+ individuals/students through 44 career path presentations utilizing 23 volunteers from 13 different companies.

It is worth noting that since 2016 the Economic Alliance has conducted over 400+ Career Oath Presentations and contacted over 40,000 Potential Workers/Students

Events

In addition to our monthly taskforce and board meetings, Economic Alliance in normal times, conducts 15 annual events that bring together approximately 2,500 attendees with networking and exhibiting opportunities. One of its major events was the: Industrial Procurement Forum. Here members can meet and learn how to engage with some of the world’s largest production, petrochemical and maritime entities in the world.

Summary

It is the individuals of this region, our members/companies, partners, municipalities, that convene and do the work to advance the Houston Port region globally.

There is not an organization in Houston, let alone the state of Texas, that makes as much of an impact collectively on initiatives pertaining to Economic Development, Transportation, Public Policy, Workforce Development and Quality of life issues as EA.

In 2022, the Alliance looks forward to the continuation of convening its members to prioritize activities to market and grow a vibrant regional economy. It is individuals support and participation that contribute to the Houston Port region being the most sought after destination in the entire world for petrochemical, manufacturing, maritime and logistics operations.