The transition to hydrogen will have an impact on all aspect of the industry, including valves and valve applications. Valves used in hydrogen applications have a number of specific requirements they must comply with in order to meet the stringent safety standards. Valve World Americas had the opportunity to speak with valve expert Scott Moreland to gain more insight on the future of the valve market, and which valves are best suited for these applications.

By Sara Mathov and Angelica Pajkovic

The Benefit of Hydrogen

“Hydrogen is colourless, odourless and tasteless, and depending on the relevant concentration, it reacts flammable or even explosive in connection with the gas mixture of the ambient air. It is dangerous, above all, because the emission of gaseous hydrogen cannot be perceived with human senses. It is therefore paramount that testing be done and passed to meet not only extreme sealing requirements, but fugitive emissions, as well. Industry standards such as API 622, 641 and ISO 15848 will become just as or more important in this new technology.”

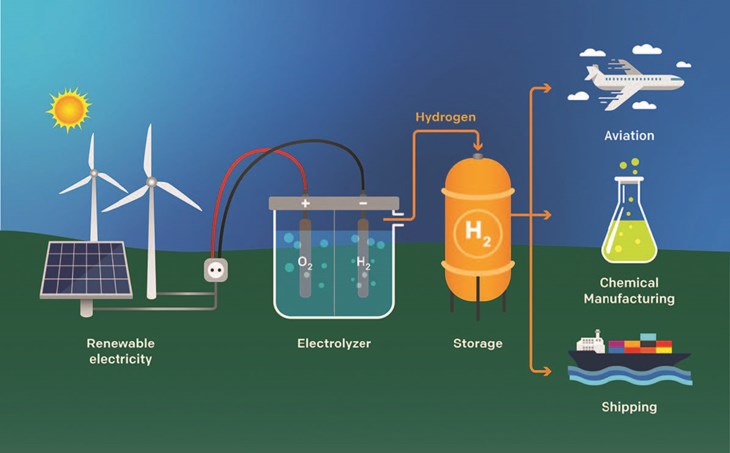

Currently, industries use hydrogen in several applications. These include petroleum refining, gas purification, semi-conductor manufacturing, aerospace applications, welding and heat-treating metals, as a coolant in power plant generators, and more.2 “It is still the early days of hydrogen, but it is coming soon, and companies are taking a great interest. Valves will be an important part of this process just like any other piping system,” explained Moreland.

The primary challenges with hydrogen are that in liquid state it has a very low temperature range, it is highly combustible, and it requires the use of specialized materials. Therefore, there are several specifications required for valves that are to be used in hydrogen applications. Due to tightness qualifications, for example, Moreland foresees that tight design offset valves will be a large player in the hydrogen market. “Seal tightness is going to be a massive thing in hydrogen bonding, and very prevalent in that market,” explained Moreland. “Although there will be the traditional shut-off classes used, the term called ‘bubble tight’ or zero leakage will be widely specified. While absolute ‘zero-leakage’ might not be totally achievable due to density of hydrogen, but very high tightness requirements will prevail. I believe this type of valve sealing will become much more predominant in the hydrogen industry.”Due to hydrogen’s unique properties, there will be specific valves used in hydrogen applications, and each valve will undergo stringent testing to qualify its use. For example, some of the most widely used valves for hydrogen applications are currently offset valves, especially in lower pressure applications. “The safety test on valves used in hydrogen are extremely important to ensure the safety of the operator as well as mitigate the risk of failure,” explained Moreland. “One of the common tests used to verify the integrity of an offset valve is the fire test. First, the test is meant to go in the direction of preferred flow. Then, it must be tested in the opposite direction, the non-preferred flow. If this has zero leakage, after burning and quenching, it is considered a success. This qualifies a valve to be truly bi-directional. The same will be utilized to qualify the key valves used in hydrogen with testing to cryogenic parameters, matching the service temperatures in hydrogen applications.”

“As the materials of construction for hydrogen applications will need to withstand extreme temperatures and be able to perform very well under various conditions, it will be rare to see something like carbon steel used for these applications,” stated Moreland. “Steels with a high carbon content are not suitable for this medium, because the hydrogen atoms allow it to become brittle with the components thereby losing their strength. The higher technologies materials, such as duplex and Inconel, will likely be the materials of choice. When choosing the materials, it will also be important to attempt to use as many like materials as possible for the various parts of the application,” he continued. “Additionally, triple offset valves, for example, have an elliptical design. The seat configuration from top to bottom is one dimension, while side to side are another; however, utilizing a full circular design, such as achieved in a quadruple (four)-offset valve, permits for the dimensions to be uniform on the disc including thickness.

This circular design allows for an energized O-ring technology to be used. As two different materials can allow for a better seal with lower friction. Inconel can be considered for the O-rings and sealing surface for instance. However, Inconel does not expand and contract at the same rate as stainless steel, which could lead to issues with performance if disc & body materials differ from the sealing mechanisms. Materials used should be as like as possible, so the expansion and contraction are uniform. This leads to additional technology in the disc to shaft connections which permit enough free movement as to allow the seal to shift into place without issue when expanding or contracting differently then the body/disc – thus providing for the tighter shutoff in long term usage (high cycles)”.

With a progressive focus on mitigating emissions and producing cleaner energy, valve manufacturers will also strive to provide a zero leakage, bubble tight valves in metal seated applications. “Elastomers can provide that zero-leakage seal in higher than cryogenic temperatures and pressures, but often do not last, or melt away with heat. So, what we will be looking for in metal-to-metal applications, is a metal seal to allow for lower temperatures and lower pressures,” explained Moreland. “Ultimately, severe service applications and zero leakage valves will become much harder to qualify as we transition to cleaner energies.”

The valve market will change as the types of commonly produced medias change with them. In hydrogen applications, Moreland indicated that traditional gate valves may become less useful, or even obsolete. “Gate valves will not likely be a major player in the hydrogen market because they inherently leak. They meet traditional allowable leakage rates based on current applications, and that is what the standards are built on. With hydrogen this allowable leakage rate will need to be close to nil. My belief is that this will eliminate a lot of gate valves for this type of application.”Offshore fields might also be more focused on greener fuels, such as hydrogen, that will allow for lower pressure piping systems. “It is a huge industry, and many people rely on it for their living. But at some point, they are going to transition out of that, and towards new technologies. That will be pushed not just by the U.S., but globally. There are many traditional oil & gas companies which are looking to transcend aging offshore facilities to convert wind power into hydrogen, then pump the hydrogen back to shore using existing petroleum pipelines and terminals.”

According to Moreland, new standards will be released with testing requirements for a number of industry applications. “We are currently on the forefront of a number of new/revised regulations and standards. Once the industry starts using hydrogen, there will be many opportunities to grow and expand within this industry. I believe, for example, that the transportation market will simultaneously shift and grow,” he stated. “Fueling stations will become more prevalent and companies will likely begin to compete more aggressively for the position as leaders of new technologies. Everyone wants to have the newest plan or come out with a CO2 capture facility, it is a great selling point to green conscience consumers.”As many major companies are looking to invest in cleaner technologies, while maintaining their previously established facilities, there will be a unique mix of oil and gas, refining, and LNG production with greener technologies. “There is a lot going on in the industrial sector, both in the United States as well as globally. While a large focus is on hydrogen, as it is a new subcategory of energy, oil is still here to stay. I think it will be very interesting to see how companies establish a balance between the two as time progresses.”

Moreland believes that the transition towards hydrogen will take full effect over the next five to six years. “Many companies are gearing up for it now. Our company, for instance, is working on creating new testing for hydrogen applications in cooperation with renowned American testing group, Yarmouth Research. Hydrogen will grow quickly, and oil and gas will be downsizing as the main focus for major IOC’s by an estimated 40% accordingly. Ultimately hydrogen will be the biggest new thing coming; it will be beneficial for valve professionals to be prepared for this transition.”

1. Fuel Cells Works. Retrieved at: https://fuelcellsworks. com/news/hydrogen-to-replace-gas-pipelines-across-new-zealand-by-2050/

2. Hydrogen Tools. Retrieved at: https://h2tools.org/bestpractices/hydrogen-applications