As detailed performance data now enables valve markets to be forecast at the individual valve level, the industry is provided with improved visibility into market share across segments and the ability to more effectively track end-user requirements.

By Robert McIlvaine – CEO – McIlvaine Company

Artificial intelligence makes it possible to easily search bid documents issued by oil & gas and engineering, procurement, and construction (EPC) companies to uncover very specific data about cryogenic valve applications and valve types.

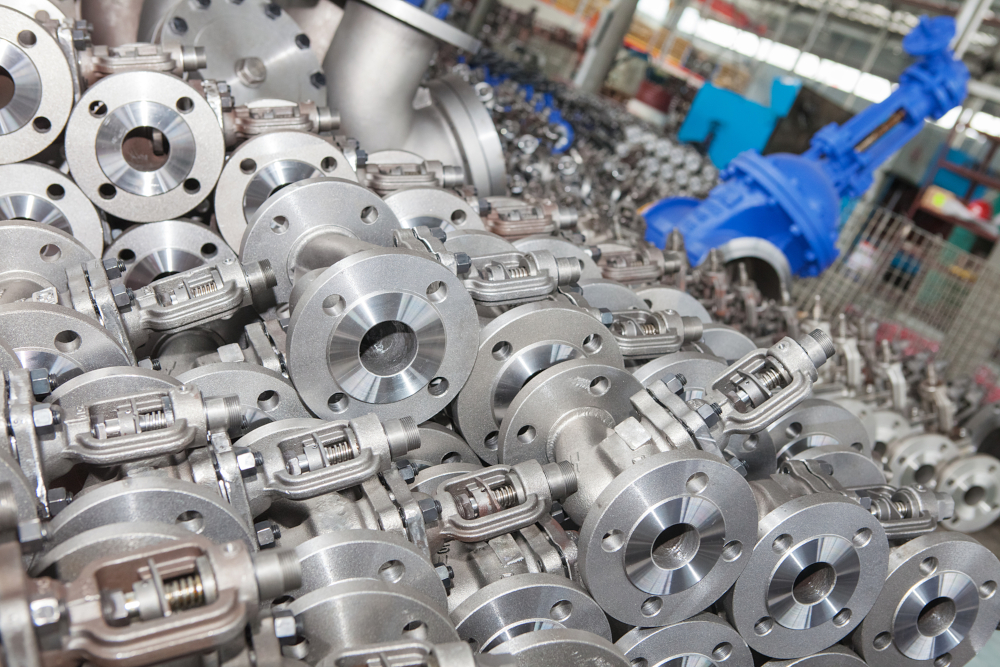

As analysts can now review detailed performance data of several types of stainless-steel castings used with these valves, markets can now be forecast down to the valve level—distinguishing between use in liquefaction facilities and regasification sites, as well as applications on tankers and in storage facilities.

It is also possible to learn in detail about valve usage in ethylene plants, including valve types and costs, and analyze products used in industrial plants producing hydrogen. This feast of information cannot be digested in a single sitting. Instead, it must be delivered in manageable, digestible bites.

Excel workbooks provide an effective platform to do this, allowing data to be displayed and analyzed by any combination of location, application, and valve type. Similarly, supplier revenues can also be detailed with results made available.

Market revenues in the industrial and power segment are displayed as examples for selected companies, and these revenues can be further broken out by valve type. The justification behind the numbers can be clearly explained. Although alternative outcomes can be debated and evaluated, this requires an organized deliberation initiative.

One unique approach is to stage a “debate” between AI-generated estimates and the numbers to compare values implied by AI searches versus those displayed in structured workbooks. For instance, with an AI debate with McIlvaine numbers over cryogenic valve market numbers, the conclusion is that both approaches have value. The AI approach reflects actual transaction prices, including discounts and lower costs in regions such as China and India.

However, AI-derived results typically do not specify what percentage of the numbers reflect discounts versus what portion is attributable to lower manufacturing costs in specific countries. In contrast, the methodology starts with volume adjusted revenue as a base and then explicitly estimates the impacts of both regional cost differences and discounts. This creates a more transparent and reliable system.

Artificial Intelligence analysis itself highlights both the advantages and limitations of this approach. As a result, users of pivot tables gain not just data, but a reasoned deliberation on value, which is supported by conclusions drawn from the world’s available sources.

A major challenge is keeping pace with the many developments in cryogenic valve markets. Hydrogen is a major growth sector, but it is advantageous to segment the cryogenic valve market into two primary categories:

• Industrial and Power – including larger valves.

• Specialty and Mobile – including medical devices and hydrogen mobility applications.

There are companies that represent both segments, but for those where industrial and power markets are significant, the small valve specialty market often is not. Put differently, leaders in one segment are not necessarily leaders in the other.

Determining market share in both segments is therefore critical. This segmentation becomes especially important when forecasting future market share. The cryogenic valve market is a growing segment of the overall valve industry and warrants continuous evaluation.