As the world grapples with the pressing challenge of mitigating climate change, Carbon Capture and Storage (CCS) technology has emerged as a critical tool in the global effort to reduce greenhouse gas emissions. In 2024, CCS technology is at the forefront of innovation, with advancements across the entire spectrum of capture, transport, and storage technologies.

By Foster Voelker II, Director of Engineering – Williams Valves

CCS is a crucial technology in the global effort to mitigate climate change. As nations worldwide aim to meet their carbon reduction commitments, CCS has emerged as a viable solution, particularly for those industries that are challenging to decarbonize.

Global Overview of CCS Deployment

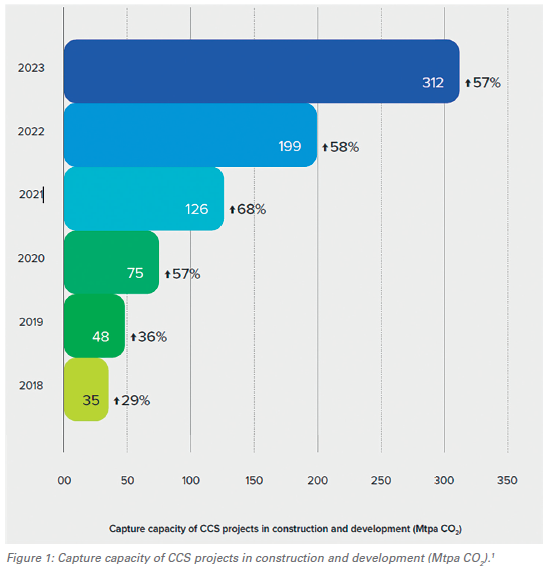

As of 2023, the global CCS landscape is experiencing significant growth. The total CO2 capture capacity of CCS projects – encompassing those in development, construction, and operation – has reached 361 million tonnes per annum (Mtpa), marking nearly a 50% increase compared to 2022. This surge in capacity reflects the escalating importance of CCS in global climate strategies. The number of facilities in the development pipeline has also doubled year-on-year, with 392 projects under construction as of July 2023.1

One of the most significant trends in CCS deployment is the rise of CCS networks, also known as hubs or clusters. These networks involve shared CO2 storage infrastructure, which reduces costs and enhances the feasibility of CCS projects by allowing multiple sources to capture, transport, and store CO2 collectively. By 2023, over 100 such networks were in development globally. These networks are essential for achieving the large-scale deployment required to meet mid-century net zero targets, as the storage of around 10 Gtpa of CO2 is necessary to reach these goals.1

Europe and the United Kingdom are making significant strides in scaling up CCS deployment, driven by rigorous climate policies and robust financial commitments. The European Union has allocated €3 billion through the Innovation Fund to support climate technologies, including CCSA, while the U.K. government has pledged £20 billion over the next two decades to advance CCS projects. A key focus in Europe is the North Sea, where numerous CCS initiatives are leveraging the region’s vast offshore storage potential.1

North America is at the forefront of CCS deployment, driven by strong policy support and substantial financial investments. In the United States, the Inflation Reduction Act (IRA) of 2022 has been a game-changer, unlocking over USD $300 billion for clean energy projects. State-level initiatives are also playing a critical role in the expansion of CCS. For example, Louisiana is emerging as a leader in CCS development due to its favorable geological storage capacity and supportive regulatory environment. Additionally, the U.S. Environmental Protection Agency (EPA) has been active in updating regulations to support CCS deployment. The EPA’s recent rule proposals focus on reducing carbon dioxide emissions from power plants and granting states like Louisiana primary enforcement authority (primacy) for Class VI wells, which are essential for CO2 storage.1

In the Asia-Pacific region, countries like Japan and Australia are increasing CCS investments. Japan aims to store 240 Mtpa of CO2 by 2050, with commercial CCS facilities expected to be operational by 2030. Australia is also leading in CCS technology with the CarbonNet project, which focuses on storing CO2 from industrial sources in Victoria’s Grippsland Basin.

Despite the progress, CCS deployment faces several challenges. One of the primary concerns is the development of sufficient geological resources. Although the number of CCS projects is increasing, the development of storage resources is not keeping pace, particularly in Europe.1 Regulatory frameworks also present a challenge, especially in regions like Southeast Asia, where the lack of CCS-specific legislation is a significant barrier to commercial scale deployment.1 This disparity could hinder the scaling up of CCS to the levels required to meet global climate targets.

Technological Advancements and Future Prospects

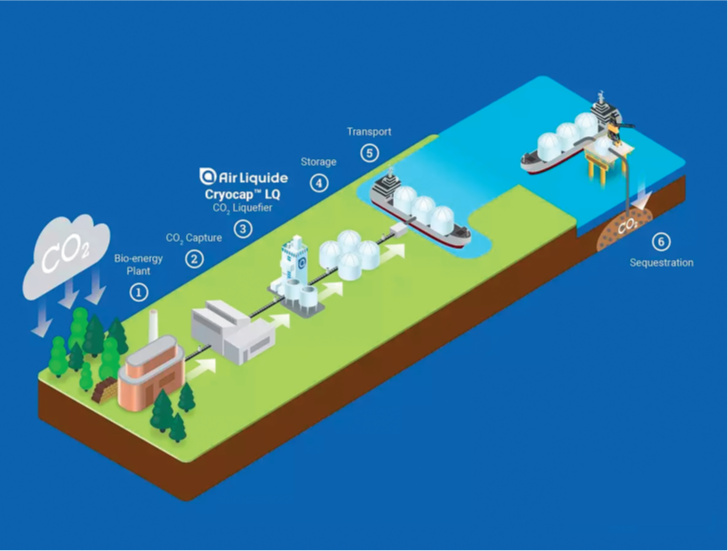

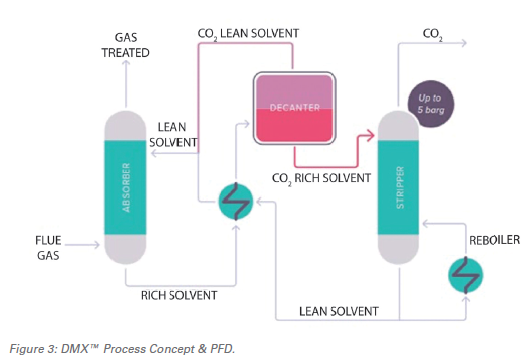

Technological innovation remains at the heart of CCS progress. The State of the Art: CCS Technologies 2024 report showcases a range of cutting-edge technologies that are redefining the efficiency and cost-effectiveness of CCS. Companies like Air Liquide and Axens have developed advanced capture solutions such as the Cryocap ™ and DMX™ processes, which offer high capture efficiencies and lower operational costs. For instance, the Cryocap™ technology achieves CO2 capture rates of up to 99% by using cryogenic separation, while the DMX™ process reduces CO2 capture costs by 30% compared to traditional methods by utilizing a unique solvent that can undergo phase separation when heated. This solvent is divided into two phases – a CO2-rich phase and a CO2-lean phase. Only the CO2-rich phase requires regeneration, which significantly reduces the energy required for the process.2

In addition to capture technologies, significant advancements have been made in CO2 transport and storage. Baker Hughes’ Compact Carbon Capture (CCC) system, which employs Rotating Packed Bed (RPB) technology, exemplifies innovation in transport technologies. This system dramatically reduces equipment size and costs while maintaining high capture efficiency, making it ideal for small to medium-sized emissions sources.2

Additionally, the EPA has outlined several potential advancements in CO2 capture technologies, including improved solvents, carbonate fuel cells, exhaust gas recirculation, new membrane technology, and chemical looping.3 These innovations are expected to reduce the costs and energy penalties associated with CCS, making it a more attractive option for a wider range of industries.

Beyond technological advancements, there is a growing focus on Direct Air Capture (DAC) technologies, which involve capturing CO2 directly from the atmosphere. The U.S. Department of Energy has announced significant funding for DAC projects, including up to USD $1.2 billion for the development of two commercial scale DAC facilities in Texas and Louisiana.1

The Road Ahead

As we look ahead to the rest of the decade, the continued expansion of CCS will be critical to achieving global climate goals. The technology’s ability to capture and store emissions at scale makes it an indispensable part of the transition to a low-carbon economy. However, realizing the full potential of CCS will require continued investment, robust policy support, and effective public engagement.

In regions like North America and Europe, where regulatory and financial frameworks are already well established, the focus will likely be on scaling up existing projects and developing new hubs and networks. In emerging markets like Asia-Pacific and Africa, the priority will be on building the necessary infrastructure and policy frameworks to support large-scale CCS deployment.

In conclusion, while there are still many hurdles to overcome, the current status of CCS in 2024 is one of cautious optimism. The significant progress made in recent years demonstrates that with the right support, CCS can play a vital role in mitigating climate change and helping the world achieve its net zero targets. As technology continues to evolve and mature, it is poised to become a cornerstone of the global effort to reduce greenhouse gas emissions and protect our planet for future generations.