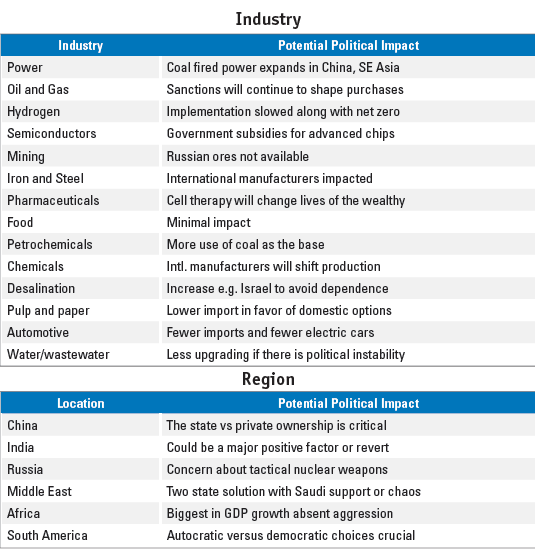

The McIlvaine Company has been making predictions about the valve markets for decades. The political winds have been of minor importance. The big variables have been in economics. The new reality is that political forces will shape the AWE market in the coming years in an unprecedented way. If the winds are favorable there will be 2 billion more people in 2050 and global GDP will be twice that of today. The valve revenues could be $200 billion. The requisite value would also be $200 billion. In other words, with competition, the lowest cost of ownership products will be purchased.

By Robert McIlvaine, President & Founder – The McIlvaine Company

If the world becomes less stable without the guidance of the G20, the 2050 valve revenues could be no greater than they are now (USD $100 billion). The value could fall to USD $80 billion as funds are not spent on the lowest total cost of ownership (LTCO) of products.

99% of the world’s population has seen nothing but prosperity. But in 1944 European and Asian production was a small fraction of the 1938 levels. China and Russia are already dealing with unfavorable political winds.

The Group of Twenty (G20) comprises of the world’s major economies. The G20 represents all inhabited continents, 80% of world GDP, 75% of global trade and 60% of the world’s population. China and Russia are members. The member countries can take credit for the current prosperity. Here is what the political winds may blow.

The European Union Investment in the Defense Industry

The EU spent a record USD $ 240 billion on defense spending in 2023, but it now realizes that the U.S. may be an unpredict- able supplier. Therefore, it needs to build up its own defense. The EU is debating a new €100 billion special fund to buy urgently needed equipment for Ukraine from European suppliers. The fund should focus on identifying Ukrainian needs—whether ammunition, tanks, armoured vehicles, artillery, small drones, demining equipment, air defence or munitions. The equipment Ukraine needs to fight Russia is the same equipment Europe should have on hand as well. This would build European Union’s ASAP initiative and would address its limitation—the lack of funding—enabling the European Union to submit the orders and dramatically scale up production, as well as expand the initiative to other areas of need for Ukraine.

The Middle East political winds are blowing in many directions. Saudi Arabia is the only country with significant valve production. The UAE and others have the interest and the funds. Israel is the base of considerable valve technology. Halonium was just recently purchased by IIT.

Italy is a leading exporter of valves to the Middle East. The only significant operation for hard facing of valve castings is in Saudi Arabia so most severe service valves are imported.

One of the favorable winds is the growing GDP in the Middle East. A tornado of unfavorable winds threatens peace between Israel and its neighbors and its neighbors, and is threatening to bring Iran into the fray. into the fray. This could result in a wider conflict with the U.S. and the EU.

There is the possibility that the Tornado will be avoided and there will be a two State solution which could result in prosperity for the region.

Vendors of valves and systems will be leveraging automation and AI to efficiently supply and help operate plants around the world. Ore will be mined, processed, and transported without the need of operating personnel.

Wind, solar, hydrogen, and BECCS greenhouse gas concentrations will peak while pharmaceutical miracles end cancer and many other sicknesses with techniques of cell and gene therapy. Thanks in part to valve technologies, much of the food will be grown in enclosed greenhouses or ponds.

The valve industry is very international. One advantage is the ease of relocation. If the U.S. became extremely isolationist, Emerson, Flowserve, Crane, and other U.S. based companies would simply move corporate offices to another country. Valmet, Neway, and many other international valve companies could spare their staffs in the U.S.

There is a threat that the U.S. could impose a 10% tariff on valves coming in from any country except China where the 18% would remain in place. This blanket tax would be renegotiated for certain countries. This will bring in the federal government to modify free enterprise.

The high efficiency of the valve industry has been created by outsourcing components to the countries specializing in a product such as castings. There are virtually no iron foundries left in the U.S. It is unlikely that even with automated iron foundries the U.S. could compete with India, China, and Vietnam.

The political winds have been relatively calm for 78 years. Storms are now brewing and need to be closely analyzed by valve makers.