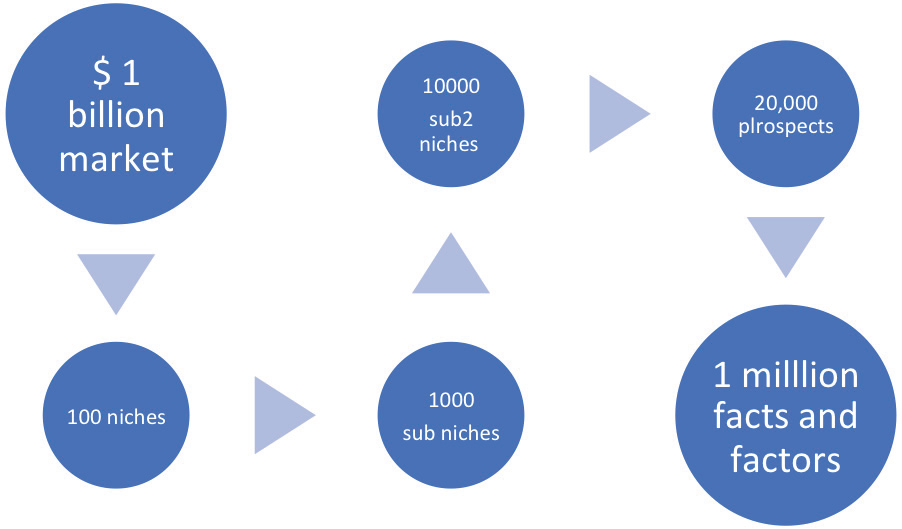

Many valve companies are pursuing the 20% of the market yielding 80% of the Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA). The most profitable market is an aggregation of $10 million niches. There are ten $1 million sub-niches each with up to ten sub-2-niches which provide the targets for the local salesmen. Each sub-niche is shaped by a value proposition which will achieve a 40% market share and 30% EBITDA. The proposition explains why a specific plant will want to pay the premium price for a valve that provides the lowest total cost of ownership. This superiority is based on the relevant specific facts and factors. For a company to achieve highly profitable revenues of $400 million it needs to pursue 100 niches and 1000 sub niches.

By Robert McIlvaine, President & Founder – The McIlvaine Company

If the average annual purchases by an individual plant are $50,000, then 20,000 prospects need to be pursued. It is necessary to take an organized approach to assess 1 million facts and factors. The Most Profitable Market (MPM) program uses the Industrial Internet of Wisdom (IIOW) to cost-effectively provide easy access to all this information.1

To achieve an EBITDA of $120 million and 40% market share in a billion-dollar market, millions of facts and factors on plants, processes, and competitors must be gathered, disseminated, and revised.

The average EBITDA in the valve market is less than 15%. But those who are focusing on the best prospects are achieving EBITDA of 30%.

Best Prospects

The best prospects are those who will benefit most from a unique value proposition. There are 50,000 large plants and over 1 million smaller plants buying valves.

Analyzing Niches

The wisdom in a particular niche can be assembled from the available data from the media, associations, institutions, and governments.

There are vast quantities of information available about valve purchasers. Valves leak causing fugitive emissions. Plants in the U.S. are required to obtain air permits detailing their expected emissions. They are also required to report each year on the releases of more than 20 toxic chemicals. Figure 2 depicts the toxic release data for one plant.

“CHICAGO (CBS) – Rescue crews are on the scene of a possible chemical leak at a plant in far southwest suburban Elwood.

The incident occurred around 9:30 a.m. on Tuesday at Stepan Chemical Co., 22500 W Millsdale Road. According to the Will County Emergency Management Agency, a relief valve opened up and a chemical called therminol was released in vapor form.”

With IIOW, intelligence from all these disparate sources can be assembled and analyzed to determine the number of valves and the facts and factors relevant to the selection of a specific valve. Detailed information is available for countries worldwide. The data available in Europe is at least equal to that in the U.S. A surprise bonus in the Chinese data is the availability of English abstracts in many valve related articles.

Final Thoughts

The program to forecast the purchases for each plant in each niche is just a supplement and reinforcement of work that is already going on through the organization. Each time a salesman makes a phone call, every inventory order by a purchasing person, each decision to participate in an exhibition, each management hiring decision are all based on assumptions about the prospects. Supplementing this with an organized system provides not only guidance but fosters discourse and information exchange among personnel. This will result in continuous improvement and consensus.

The program can and should result in 40% or greater market share and 30% or greater EBITDA. The general use of AI may be years away, but the elements can be pursued niche by niche now.

Reference:

- Most Profitable Market Program published by the Mcilvaine Company