An analysis of thousands of valve acquisitions over the last 30 years shows that the valve market is built on the niche achievements of several small companies who were acquired by publicly traded companies or private equity firms. The many benefits of mergers have recently increased due to the advent of IIoT and remote O&M which allow suppliers to provide solutions and not just products.

By Robert McIlvaine, President & Founder – The McIlvaine Company

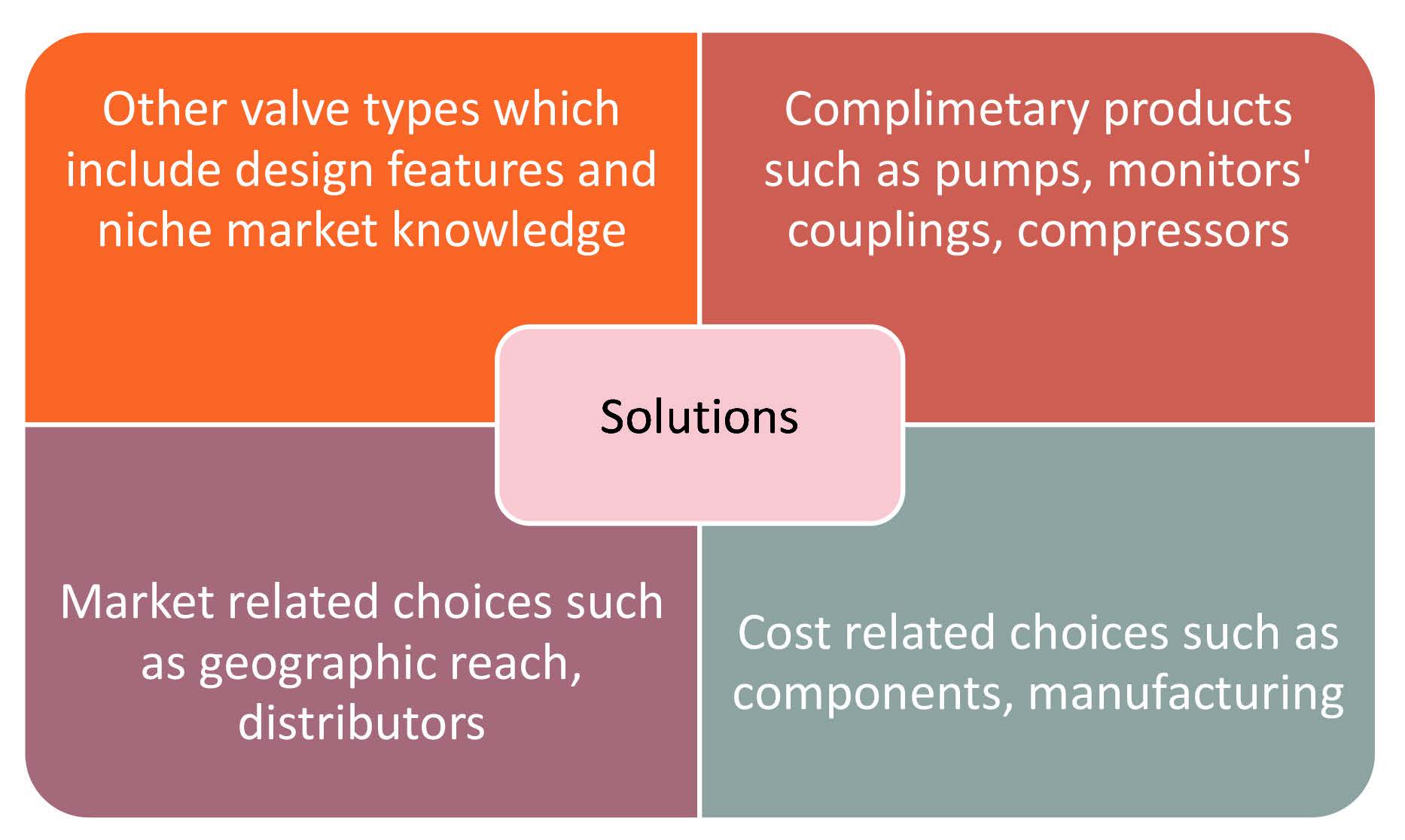

There are several motivations that can cause a valve company to seek acquisitions. The four most prevalent causes are depicted in Figure 1.

For example, one can look at the benefit for a valve company to acquire a company with complimentary products. Typically, there are a minimum of two valves, or more, which are used in tandem with every industrial pump. As remote monitoring of a pump-valve system is now cost effective, there is significant potential for large revenues to accrue for solution suppliers. This has led valve companies to acquire other system component suppliers making them total solutions providers.

Total Solutions Market

The total solutions market for valves can be defined in different ways. One is a pragmatic approach based on the capabilities and interests of a group of suppliers. This approach excludes most discrete and mobile applications. The reason for this exclusion is that a different group of suppliers typically pursue this high volume, but small, valve market. Most residential and commercial markets are also excluded. Each of the market niches in a pragmatic approach are defined in one umbrella market report.1

Valves themselves, represent a $85 billion segment of this Solutions market.2 Dryers, kilns, and furnaces are not included in the total, even though the valves used with them are. If they were to be included the valve percentage of the market drops from 11% to 7%. In general valves represent about 1% of the total installed cost of process systems.

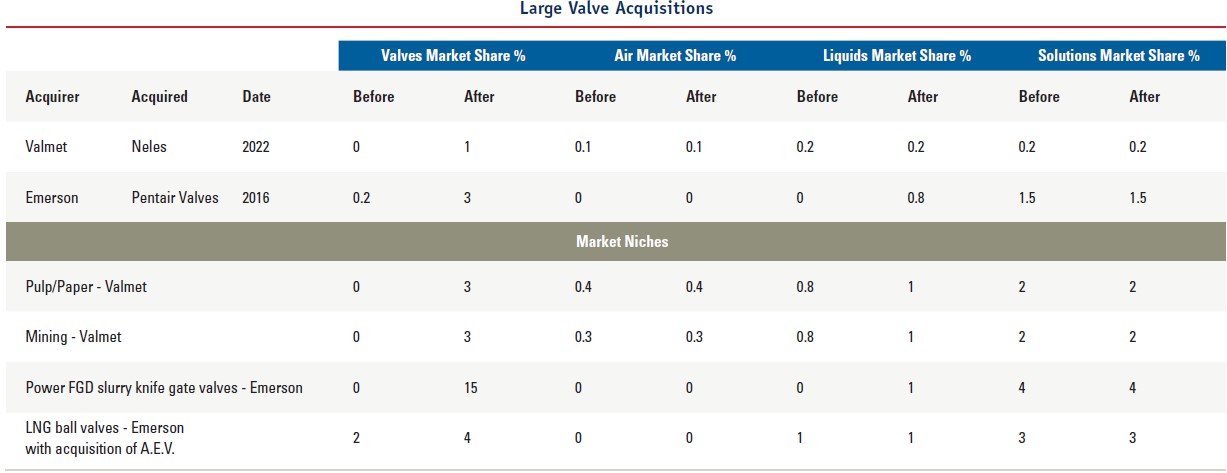

The most successful acquirers have been focused on specific market niches. The largest acquisitions to take place recently have covered several market niches, while the successful smaller acquisitions have often been focused on narrow market niches.

Larger Acquisitions and Market Niches

Thus far in 2022, the largest valve acquisition was of Neles by Valmet. The largest valve company acquisition to date was the Emerson acquisition of Pentair Valves and Controls, which took place in 2017. Neither of these acquisitions came close to achieving a double-digit market share in the total market. However, the acquisitions did result in leadership in niche markets, see Figure 3.

As an example of how these acquisitions impact the market, one can take a closer look at the valve company acquisition in 2nd quarter of 2022. On April 1st, 2022, Valmet, a global developer and supplier of process technologies, automation and services for the pulp, paper and energy industries purchased Neles. Valmet’s net sales in 2020 were approximately EUR € 3.7 billion. Neles is a provider of mission-critical flow control solutions and services for process industries; it sold roughly EUR € 576 million in 2020. The Neles acquisition therefore gave Valmet a 1% share of the valve market.

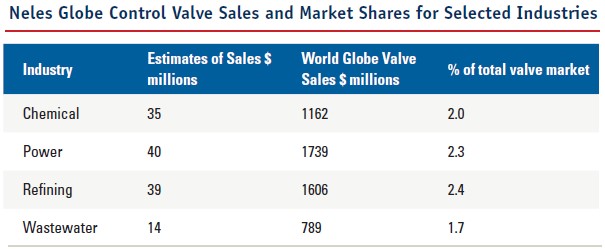

Since the merger, the company has been supplying complete air pollution control systems with valves to control scrubber flow. It is also a supplier of drum filters in pulp and ore processing, and supplies complete systems with valves. The combination of an application niche and a specific type of valve has resulted in higher market shares for Neles, see Figure 4.

Another beneficial example to consider is the Emerson Automation Solutions acquisition of Pentair Valves. This Emerson segment’s major product offerings include: Measurement & Analytical Instrumentation, Valves, Actuators & Regulators, Industrial Solutions and Systems & Software. With the acquisition of Pentair Valves, Emerson saw the potential for actuating manual isolation valves and the opportunity to provide remote operations for all valve types.

Emerson has made more than 40 acquisitions and investments in recent years.

In 2018 the company acquired Advanced Engineering Valves (A.E. Valves), a leading manufacturer of ball valves which help LNG customers operate more efficiently. In May 2022, Emerson and AspenTech announced the successful closing of the combination of Emerson’s industrial software businesses – OSI Inc. and its Geological Simulation Software business – with AspenTech to create a global industrial software leader (“new AspenTech”).

When considering these acquisitions, it becomes clear that the highest value purchases were those of niche market suppliers that resulted in a number of application/valve combinations. Clarkson is one example.

Clarkson was founded in 1950 and focused on mining valves. It developed a knife gate valve widely used in mining. In the 1980s it became the leader in knife gate valves for power plant flue gas desulfurization systems. In the late 1990s Clarkson was acquired by Tyco.

In 1997 Tyco International, with sales of over USD $6 billion, bought Keystone for over USD $1 billion. Keystone started in the 1950s as a supplier of valves to the oil and gas industry. In the late 1990s Tyco bought Sempell, Smith. LMI, and Stockham. In the 2000s the CEO was imprisoned for theft.

In 2012 Pentair bought Tyco Valves. In 2016 Emerson purchased the valves and controls group from Pentair for USD $3.15 billion.

Emerson is therefore in a strong position to supply the complete solution.

Valmet is similarly positioned and has the additional advantage of process knowledge due to the supply of air pollution and water pollution control systems.

Independent valve companies need to consider ways to compete in the supply of solutions. Fortunately, each application niche is a unique market. So solutions can be added one niche at a time.

Further Considerations

There are a few alternative options for vale companies looking to transition to the total solutions market. One option is to become part of a private equity portfolio which has complementary solution products. Another option is to become part of a collaborative group. Independent cleanroom laundries around the world have banded together as Micronclean. The Star Pump Alliance, for example, is a collaboration of pump users and manufacturers.

With the international political situation as well as the advent of IIoT and Remote O&M valve suppliers will need to continually assess the opportunities and make critical decisions on a timely basis.

REFERENCES

1. Air/Gas/Water/Fluid Treatment and Control: World Market published by the McIlvaine Company

2. Industrial Valves: World Markets published by the McIlvaine Company

Bob McIlvaine founded the McIlvaine Company in 1974 and oversees the work of 30 analysts and researchers. He has a BA degree from Princeton University.

Bob McIlvaine founded the McIlvaine Company in 1974 and oversees the work of 30 analysts and researchers. He has a BA degree from Princeton University.